If you work in the financial advisor space, you’ve likely heard the term “breakaway advisor”. However, you may not be exactly sure what it means. If you ask five different people, you could get five variations of a definition.

At a high level, a breakaway advisor is an advisor that is going independent by establishing their own business or practice. It can be a big change for the advisor breaking away as the large established financial institutions in the industry operate very differently from many of the independent financial shops.

Our goal is to help you better understand what a breakaway advisor is and what their role is in the financial advisor world.

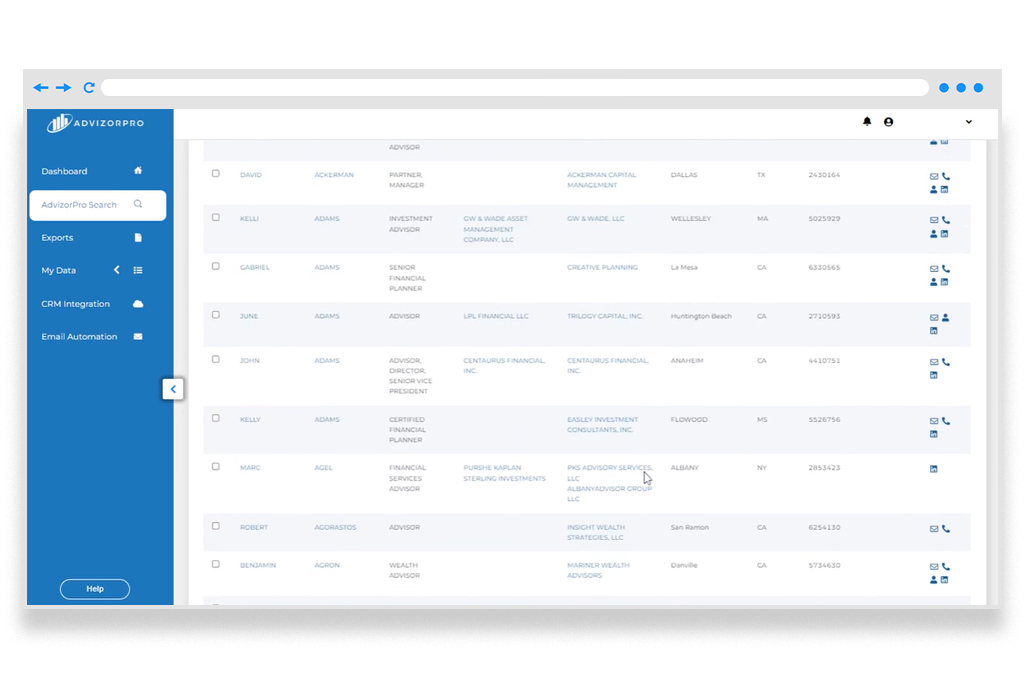

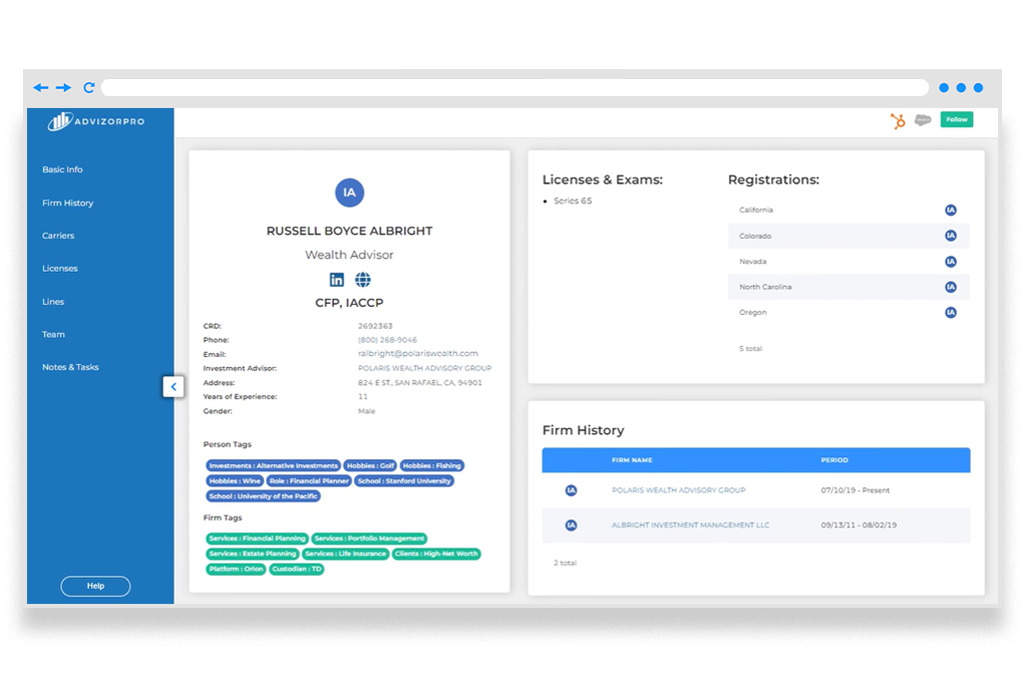

At AdvizorPro, we track data on the entire universe of financial advisors including breakaway advisors, wirehouse advisors, independent RIAs, and independent broker-dealers. We’ve made it our business to understand the data and trends in it to best serve our RIA, broker-dealer, asset manager, and fintech clients.

What is a Breakaway Advisor?

A breakaway advisor is an independent financial advisor who leaves an established financial institution, such as a bank or wirehouse, to establish their own independent practice.

A couple of example firms advisors could be breaking away from are Edward Jones or UBS. This change empowers transitioning advisors to breakaway and assume complete control over their business model, client relationships, investment strategies, and service offerings.

By embracing the role of a breakout advisor, these individuals seize the opportunity to shape their future and build their professional brand in a rapidly changing industry. Without the ability to pivot and change fast, it’s easy for an advisor to get left behind significant trends in the industry.

Breaking away is a big decision for advisors as it requires transferring their current clients to a completely different institution. This can be complex, time consuming and there is risk of losing clients.

Reasons Financial Advisors Break Away

The choice to start your own practice and become a breakaway advisor is influenced by many factors, but really boil down to a desire for autonomy, growth, and greater flexibility.

A common driver is the aspiration for increased independence. Breakaway advisors want the freedom to craft their unique approach to financial planning without being handcuffed by the constraints of corporate policies or mandates.

This autonomy extends to fiduciary capacity. When advisors breakaway, they can truly put their clients’ best interests above all else and enhance client experience, by building deeper, more personalized relationships based on trust and individualized financial goals.

Financial incentives also feature prominently in financial advisor thinking and the decision to break away. Independent advisors often enjoy a more direct connection between their efforts and their earnings. This financial autonomy can serve as a powerful motivator, as advisors reap the rewards of their hard work and earn a higher payout more immediately and directly.

Challenges a Financial Advisor Will Face When Breaking Away

While the prospect of independence is enticing, the journey to becoming a successful breakaway advisor has its challenges. One of the main hurdles is the breakaway transition itself.

Starting an independent practice requires detailed planning, a robust business and digital marketing strategy, and the adoption of a suitable tech stack. This includes selecting and implementing the right tools for portfolio management, client communication, compliance tracking, performance reporting, and much more.

Client retention is another formidable obstacle. Moving from an established institution to an independent practice can trigger concerns among clients about the stability and resources available, impacting the overall client advisor relationship.

Overcoming this demands effective communication that underscores the benefits of the breakaway advisor model – from personalized attention to a wider range of investment opportunities. There are many independent advisors that have done this successfully.

The Future of Breakaway Advisors

The future looks promising for breakaway advisors as the industry continues to evolve. In an era where clients are increasingly seeking personalized and holistic financial services, breakaway advisors who establish their own registered investment advisory are uniquely positioned to cater to these demands. Their autonomy enables them to offer tailored solutions that align with individual client needs and support their long-term objectives.

Moreover, the rapid increase in advanced technology has leveled the playing field for independent advisors. These accessible online tools and tech platforms empower breakaway advisors to provide sophisticated services, maintain operational efficiency, and seamlessly navigate the complexities of the modern financial landscape.

This tech-driven edge positions them as contenders against larger institutions, demonstrating that size does not necessarily equate to service quality. This has been the single biggest catalyst for the growth in the number of breakaway advisors.

Insights from AdvizorPro’s RIA Database

AdvizorPro’s RIA Database includes data on all active breakaway advisors, as well as those advisors that may be most likely to break away. The database offers a depth of data and trends related to the growth, success rates, and niches of independent practices.

Recruiters, asset managers and fintech platforms can harness this information to identify the best independent advisor partners today and in the future.

Conclusion

Fueled by a desire for independence, a commitment to personalized client experiences, and the allure of immediate financial incentives, breakaway advisors are rewriting the rules and a group of advisors that many in the industry desire to partner with.

It is one of the advisor subsets that we get asked about the most at AdvizorPro. Contact us today to learn more about how you can identify breakaway advisors to partner with.