What is a Family Office?

Imagine a wealthy family sitting on a hefty fortune, say around $100 million in assets. What should they do with this money? Well, they build a family office – think of it as their exclusive financial advisor. This privately held company specializes in managing their investments and wealth, ensuring their assets grow and transition seamlessly to future generations. Essentially, it’s the nucleus of their financial strategy, where all the intricate financial planning takes place.

Difference between Family Offices and Traditional Wealth Management Shops

While traditional wealth management shops focus primarily on investment management, family offices handle that and much more. Family offices are committed to a comprehensive understanding of the unique requirements of each family they serve. Their approach is characterized by a deep-dive into the dynamics and financial objectives of the family, resulting in a bespoke investment strategy tailored to suit individual needs. In essence, they operate as “deeply engaged” financial advisors, prioritizing personalized solutions over generic offerings to ensure optimal wealth management outcomes.

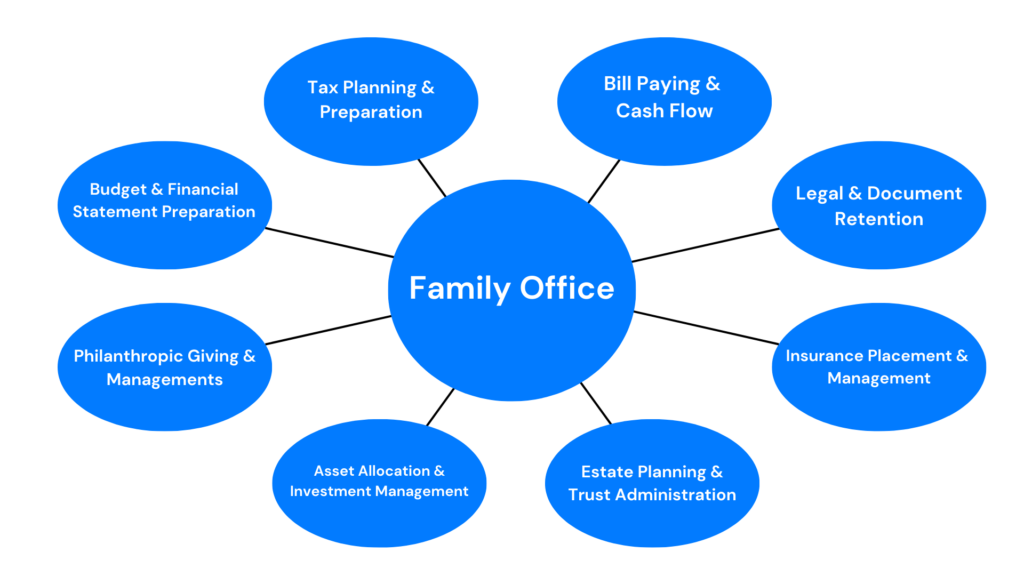

Family offices commonly offer all the services of a traditional wealth management firm like:

- Centralized management or oversight of investments

- Tax Planning

- Estate Planning

- Charitable giving

Along with traditional wealth management services, family offices often offer:

- Tax compliance work

- Access to private banking and private trust services

- Document management and recordkeeping services

- Expense management

- Bill paying

- Bookkeeping services

- Family member financial education

- Family support services, and family governance

Basically anything to do with a family’s day-to-day affairs. There are as many variants for the family office as there are families that use them.

Why are Asset Managers looking to work with Family Offices?

Family offices manage substantial wealth, often reaching staggering figures. Partnering with just one of these institutions can lead to significant capital access from a single source. Family offices seek enduring relationships, prioritizing stability and trust. Secure a solid partnership with one, and you’ve secured a steady stream of business for the foreseeable future.

Here’s the catch: Family offices aren’t interested in off-the-shelf solutions; they demand bespoke, meticulously crafted strategies tailored to their unique circumstances. Asset managers who can deliver unique investment opportunities as well as ones that align with the family’s goals are the ones who stand out in the crowd.

Word of mouth can spread fast. Success with one family office often leads to introductions within their affluent network. It’s a ripple effect, where one opportunity begets another, propelling asset managers to greater heights. So, working with family offices isn’t just about immediate financial gain – it’s about forging enduring partnerships and leveraging opportunities for mutual growth.

The Challenges of Getting In Touch With Family Offices

Reaching out to family offices is a bit of a puzzle. Asset managers have a few hurdles they might encounter:

- Gatekeepers Galore: Family offices are like fortresses, guarded by gatekeepers – think executive assistants, and sometimes even family members themselves. Getting past these gatekeepers to reach the decision-makers can be a difficult hurdle.

- Limited Visibility: Unlike corporations or publicly traded companies, family offices often fly under the radar – they are not trying to attract new clients. Their contact details are often not publicly available, which means tracking them down can be a bit like searching for a needle in a haystack.

- Trust is Key: Family offices place a premium on trust and discretion. They’re not going to open their doors to just anyone who comes knocking. Building rapport and establishing trust takes time and patience – it’s not something you can rush.

- Competitive Landscape: Family offices are hot property in the world of finance, and you’re not the only one vying for their attention. You’re competing with a whole slew of other asset managers, advisors, and service providers, all clamoring for a piece of the pie.

- Niche Preferences: Each family office is unique, with its own set of preferences, priorities, and investment philosophies. What works for one might not work for another, so there’s no one-size-fits-all approach to getting in touch.

Navigating these challenges requires a mix of persistence, creativity, and a genuine commitment to building meaningful relationships. It’s like a game of chess – you must think several moves ahead and be willing to adapt your strategy as you go. But with the right data, information, and approach, getting in touch with family offices is definitely within reach.

Data Informed Decision Making

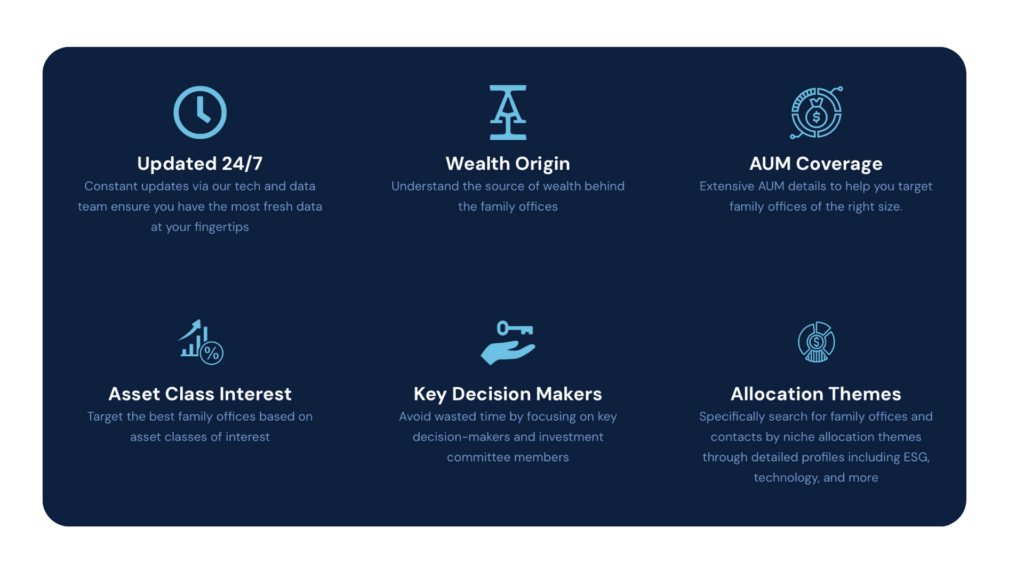

There are databases that offer a wealth of insights into the world of family offices. By tapping into this resource, asset managers gain access to invaluable data on family office investment strategies, preferences, and risk appetites. Asset managers can target family offices that align with the investment strategies in order to enhance portfolio growth. Tools like AdvizorPro’s database allow asset managers to search family offices by:

- AUM

- Location

- Key Decision Makers

- Wealth Origin

- Use of external managers

- Asset Class Interest

- Industry Interest

- Current portfolio

- Allocation Themes

And more…

Personalized Pitches and Targeted Approaches

The AdvizorPro family office database helps asset managers target family offices that best fit their investment offerings. By leveraging insights from the database, asset managers can customize their outreach to align with the investment strategies and preferences of family offices. Whether it’s real estate, technology, or sustainable investing, asset managers can tailor their pitches to resonate with the specific interests and goals of their target audience. This personalized approach not only enhances the effectiveness of asset managers’ outreach efforts but also increases the likelihood of success in securing partnerships with family offices.

Unlocking Success with Family Office Insights

Asset managers can unlock new opportunities for portfolio growth by tapping into family office insights that make finding the right prospects much easier. With the right tools, asset managers have the ability to target their outreach efforts more effectively. By understanding the unique needs and preferences of family offices, asset managers can position themselves as trusted partners and advisors, ultimately driving success and growth in their portfolios. Family offices can be a lucrative opportunity, and overcoming the challenges of getting in touch with the right one is the first step towards growth.