Advisor Moves - February 2025

.avif)

.avif)

February brought notable activity across the financial advisory landscape, with thousands of professionals changing firms, exiting the industry, or taking on new roles. Using AdvizorPro’s proprietary advisor tracking, we identified the firms with the most advisor inflows, the largest outflows, and the primary drivers behind these moves.

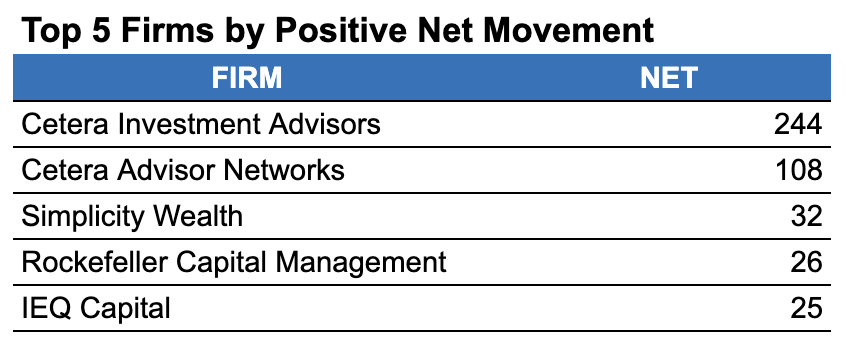

Top Firms for Advisor Hires

Cetera Investment Advisers – 269 New Registrations

Cetera continues to attract advisors through its advisor-first culture, technology suite, and flexible hybrid RIA model. The strong inflows highlight the firm’s growing appeal among advisors seeking both independence and institutional support.

Cetera Advisor Networks – 138 New Registrations

As part of the broader Cetera ecosystem, Cetera Advisor Networks has benefited from the same strategy: a focus on scalable infrastructure, personalized support, and a strong sense of community across its network.

LPL Financial – 130 New Registrations

LPL Financial remains a top destination for advisors breaking away from wirehouses. Its strong technology stack, open architecture, and operational flexibility continue to make it a leader among independent broker-dealers.

J.P. Morgan Securities – 56 New Registrations

The J.P. Morgan brand continues to attract advisors interested in serving high-net-worth clients. The firm’s deep resources, integrated wealth management platform, and institutional research access remain a draw.

Morgan Stanley – 55 New Registrations

Morgan Stanley’s steady hiring reflects its continued investment in digital platforms and advisor development programs. Its global reach and institutional capabilities make it a consistent contender for top talent.

For more insights into firms shaping the RIA landscape, explore the Top Independent RIAs of 2025.

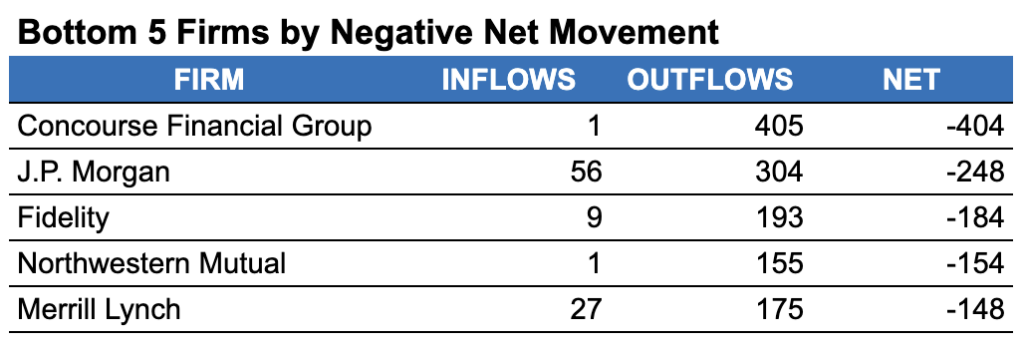

Firms with the Largest Advisor Departures

Concourse Financial Group Securities – 405 Departures

These departures largely stem from Cetera’s acquisition of Concourse. Integration processes and cultural adjustments often prompt advisors to transition within or beyond newly merged networks.

J.P. Morgan Securities – 304 Departures

Despite ongoing growth, turnover remains high as advisors seek new compensation models and greater flexibility. This duality reflects the dynamic nature of large-scale institutions balancing inflows and outflows simultaneously.

Fidelity Brokerage Services – 193 Departures

Fidelity’s advisor exits may reflect internal restructuring or a pivot among advisors seeking fully independent channels. Its traditional brokerage model continues to face pressure from hybrid and fee-based competitors.

LPL Financial – 178 Departures

Even industry leaders see turnover. The competitive independent landscape means advisors regularly re-evaluate firm alignment based on technology, payouts, and autonomy.

Merrill Lynch – 175 Departures

Merrill continues to face the long-term shift of advisors moving from wirehouses to independent models. Despite outflows, it remains a key player with strong brand equity and client relationships.

For more on these movements, see our Advisor Movement Trends Report 2025.

Why Advisors Moved in February

Mergers and Acquisitions

Advisor transitions often follow firm integrations, as seen with Concourse. Post-acquisition cultural fit, compensation changes, and new systems frequently influence retention decisions.

Search for Independence

More advisors are seeking flexibility and control over their practices. Platforms like Cetera and LPL Financial continue to thrive by empowering advisors to build their businesses independently.

Compensation Structures

Revised grid models and incentive changes play a significant role in advisor churn. Advisors increasingly look for firms offering transparent, performance-based compensation.

Technology and Client Experience

Tech-forward firms consistently outperform in recruitment. Platforms that prioritize client engagement tools and seamless digital experiences have a competitive edge.

Culture and Brand Alignment

Advisors place strong value on firm culture. Those aligning with brands that match their client philosophy and long-term goals are more likely to remain loyal.

Staying Ahead of Advisor Movement

Advisor transitions are a constant in wealth management. AdvizorPro tracks these moves in real time—helping firms:

• Identify breakaway trends early

• Target potential recruits with precision

• Understand competitive shifts across regions and channels

Learn more about how our platform enables smarter prospecting and recruiting in the How It Works overview.

Stay Ahead with Real-Time Advisor Intelligence

February’s activity reinforces the evolving nature of advisor recruitment, with independence, technology, and firm culture driving key decisions. Understanding these dynamics before they become public gives firms a critical advantage.

With AdvizorPro, you can track advisor transitions, team movements, and firm growth patterns as they happen—empowering your recruiting and strategy teams to act first.

Start prospecting smarter today. Request your free trial.

Related Post

Related insights you may find valuable

.avif)

.avif)

.avif)