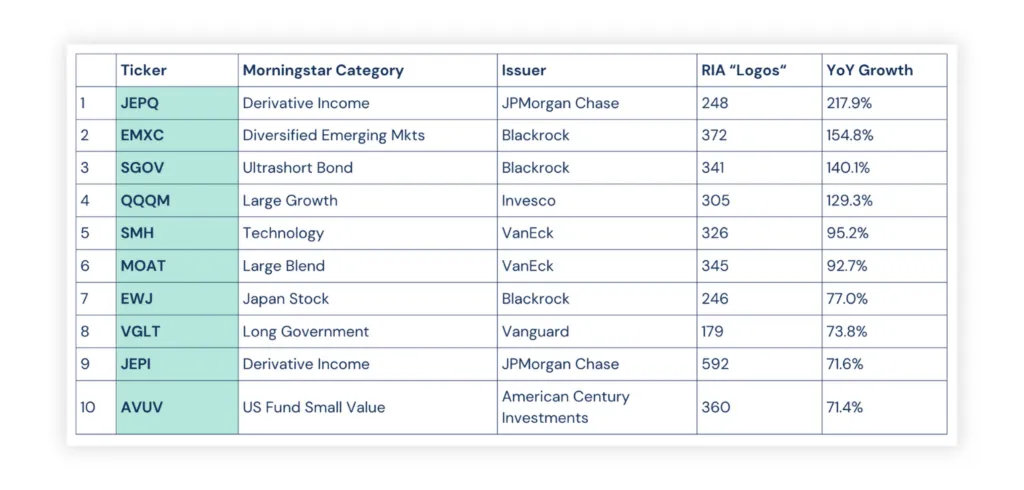

Highest Growth ETFs among RIAs 2024

.avif)

.avif)

Using the AdvizorPro RIA database, we crunched the numbers to identify the ETFs with the highest growth held by Registered Investment Advisors (RIAs). We focused on ETFs with over $10 billion in Assets Under Management (AUM). Our analysis was based on two key factors:

- The number of RIA logos (indicating the number of unique RIAs holding each ETF)

- Year-over-year growth

For additional market perspective, we also referenced ETF.com for fund-level insights. To see broader allocation patterns, check out our Q2 2024 ETF Trends Report.

JEPQ is an actively-managed fund of US large-cap companies from the Nasdaq-100 Index, assessed and managed using ESG factors and a proprietary data science driven investment approach. The fund also invests in ELNs in seeking income generation.

JEPQ actively and significantly invests in US large-cap stocks comprising its benchmark, the Nasdaq-100 Index, while pursuing lower volatility. The fund may also invest up to 20% of the portfolio in equity-linked notes (ELNs) issued by counterparties, including banks, broker-dealers or their affiliates, to provide additional income. In managing the fund, a proprietary investment approach is utilized wherein data insights, such as fundamental research, company fundamentals, and alternative data from public disclosures are extracted, processed, analyzed, and combined, in order to identify securities with attractive valuations. The advisor also assesses risks by analyzing potential threats and evaluates the impact of environmental, social and governance (ESG) factors on individual securities. Due to its active nature, the fund may still invest in other equity securities not included in the benchmark as the advisor deems fit.

EMXC tracks a market-cap- weighted index of emerging-market firms, excluding China. The index covers 85% of the universe by market cap.

EMXC tracks the MSCI Emerging Markets ex China index. Due to growth, China has received considerably increased weight in ETFs that track versions of the full index (such as siblings EEM and IEMG). EMXC is designed for investors who prefer to tailor their exposure to China separately. The index covers roughly 85% of the market cap of 25 emerging market countries excluding China. Note that the fund excludes small-cap exposure. During the May and November semi-annual index reviews, the index is rebalanced.

SGOV tracks a market-value weighted index of US Treasuries maturing in less than or equal to three months.

SGOV offers vanilla exposure to ultra-short-maturing fixed income securities of the US Treasury market. The fund is tracking the ICE 0-3 Month US Treasury Securities Index whose components are selected and weighted by market value, and rebalances every month. Securities included in the index are USD-denominated with fixed coupon schedule and have minimum 50 remaining days to final maturity (up to 3-months), while inflation-linked securities, cash management bills and zero-coupon bonds are excluded for the selection. The index does not reinvest coupon payments or maturity proceeds between each rebalance. As a result, the fund may invest up to 10% of its portfolio in money markets as well as in futures, options, swaps and cash-like instrument as advised by its fund manager.

QQQM is passively managed to track a modified-market-cap weighted narrow index of 100 NASDAQ-listed stocks, excluding financials.

QQQM, also known as a smaller version of QQQ, invests in the largest domestic and international stocks listed on Nasdaq. QQQM reflects companies from all major sectors, except financial firms, as classified under the Industry Classification Benchmark. Eligible security types are traded stocks, tracking stocks, shares of beneficial interest, limited partnership interests, and ADRs. Holdings are weighted using a methodology that is a hybrid of equal and market-cap weighting. Under this methodology, each issuer is capped at 24% weight. In comparison, QQQM is marketed towards buy and hold investors and QQQ may be preferred for trading purposes. The index is rebalanced quarterly and reconstituted annually.

SMH tracks a market-cap-weighted index of 25 of the largest US-listed semiconductors companies.

SMH is a highly concentrated fund that invests in common stocks and depositary receipts of US-listed semiconductor companies, similar to our benchmark. Midcap companies and foreign companies listed in the US can also be included. To be initially eligible, 50% of company revenues must be primarily in the production of semiconductors and semiconductor equipment. The top 50 eligible companies by market cap are then given two separate ranks based on free-float market capitalization in descending order and three-month average-daily-trading volume in descending order. Those two ranks are summed and the highest ranked 25 companies are selected. A capping scheme is applied to ensure diversification and more weight is given to the larger companies.

MOAT tracks a staggered, equal-weighted index of 40 US companies that Morningstar determines to have the highest fair value among firms with a sustainable competitive advantage.

MOAT holds a concentrated portfolio of stocks that are attractively priced and have sustainable competitive advantages (patents, high switching costs, etc.). Morningstar's equity research team determines the funds selection by assigning an economic rating and a fair value estimate to the companies in the Morningstar US Market Index. Despite its safe-sounding name, MOAT makes radical departures from market-like coverage. The fund favors single-name positions and may have significant sector biases. It follows an equal-weighted index with a staggered rebalancehalf the portfolio is reconstituted with equal weights every six months, and the other half follows three months later. MOAT also caps turnover and sector exposure. This results in the fund holding more than 40 names at times.

EWJ tracks a market-cap-weighted index which covers roughly 85% of the investable universe of securities traded in Japan.

EWJ provides broad exposure to the Japanese equity market. It was the first Japan-focused ETF to launch in 1996 and quickly became the bellwether for US-based investors wanting Japanese market exposure. The fund excludes the bottom 15% of Japanese companies by market cap, which tilts it slightly larger than our broad benchmark. Otherwise, EWJ is well aligned with the Japanese stock market. While its headline expense ratio stands out as high versus segment peers, actual holding costs as measured by tracking data are more competitive. The fund is a titan when it comes to both on-screen and block liquidity. Ease of trading and massive AUM make EWJ a staple in the segment and combined with marketlike exposure earn the nod for Analyst Pick.

The fund tracks a market value-weighted index of fixed income securities issued by the US Treasury, excluding inflation-protected bonds, with maturities of at least 10 years.

The fund is passively managed to invest across the entire long-term US Treasury spectrum (10 years and longer), excluding inflation-protected bonds. Its long effective duration, weighted average maturity and yield-to-maturity naturally exposes investors to higher interest rate risk, but not any more than is market-like. The fund uses a sampling method in tracking the index, which means it will invest in a sample of securities that collectively have an investment profile similar to that of the underlying index.

JEPI is an actively-managed fund that invests in large-cap US stocks and equity-linked notes (ELNs). It seeks to provide similar returns as the S&P 500 Index with lower volatility and monthly income.

JEPI curates its portfolio by selecting stocks from the S&P 500 Index using a process to identify value stocks with favorable risk/return characteristics along with ESG considerations. After selecting and ranking the securities, the final portfolio looks to hold those securities with lower volatility relative to the benchmark index. In addition, the funds adviser enters equity-linked notes to provide the returns of the S&P 500 Index with covered call options written. The objective is to provide the same return as the S&P 500 Index with lower volatility over a 3-5-year period combined with monthly income. Investors are subjected to counterparty risk in the use of equity-linked notes (ELNs). The fund may also underperform in a rapidly rising US equity market due to the call options written.

AVUV is an actively-managed portfolio of US small-cap value companies selected based on fundamental criteria.

AVUV seeks long-term capital appreciation by picking US small-cap value stocks that are highly profitable, as defined by the fund manager, across market sectors and industry groups. The funds portfolio is curated using fundamental screens, such as shares outstanding, cash flow, revenue, expenses and price-to-book value. AVUVs portfolio manager pursues the benefits of indexing (diversification, low turnover and transparency of exposure) but with the ability to add value by making active investment decisions based on information in current prices. The fund does not seek to replicate the performance of a specified index but it uses the Russell 2000 Value Index as a benchmark. The fund manager may also consider the trade-off between expected returns and taxes or trade costs in an attempt to gain trading efficiencies and avoid unnecessary risk.

ETF Growth Among RIAs in 2024

The ETFs gaining the most traction among RIAs in 2024 highlight demand for income strategies (JEPI, JEPQ), global diversification (EMXC, EWJ), and specialized growth areas like semiconductors (SMH).

For asset managers and fintech providers, understanding these trends is crucial for product positioning and prospecting. Learn more about how RIAs are shifting portfolios in our 2025 RIA ETF Trends Report, or explore how AI-powered search makes it easier to find the exact advisors allocating to these funds.

Want to identify which RIAs are holding or adding these ETFs? Start your free trial today with AdvizorPro and prospect smarter.

Related Post

Related insights you may find valuable

.avif)

.avif)

.avif)