Advisor ETF Search Trends – April 2025

Behavioral signals from active advisor research across leading industry publisher platforms

Introduction & Methodology

Each month, AdvizorPro tracks ETF-related search behavior from financial advisors—primarily RIAs and broker-dealer representatives—across a network of industry publisher websites where we have data-sharing partnerships. In April, AdvizorpRo tracked over 2,150 RIAs & Broker-Dealers conducting ETF-related searches across the network. These searches reflect what advisors are researching on platforms they rely on for industry news, product information, and investment ideas.

While this data does not represent fund flows or platform activity, it offers directional insight into what advisors are actively evaluating—making it a valuable signal for distribution, product, and marketing teams tracking demand and market narratives.

Executive Summary

- Total ETF-related searches rose 22.8% month-over-month

- Highest growth seen in commodities, gold, energy, leveraged/inverse equity, and Small Blend equity categories

- Core index ETFs remained heavily researched, but cost-sensitive and sector-specific tickers saw rising attention

- ETF issuers focused on precious metals, tactical products, and real assets led in search growth

Tariff-Driven Shifts in Advisor Focus

The April 2 “Freedom Day” tariff announcement corresponded with increases in search activity tied to:

- Commodities and inflation-hedging strategies (e.g., gold, energy)

- Tactical positioning via leveraged/inverse equity ETFs

- Reevaluation of sector exposure, including Large Value and Technology, due to supply chain and global trade implications

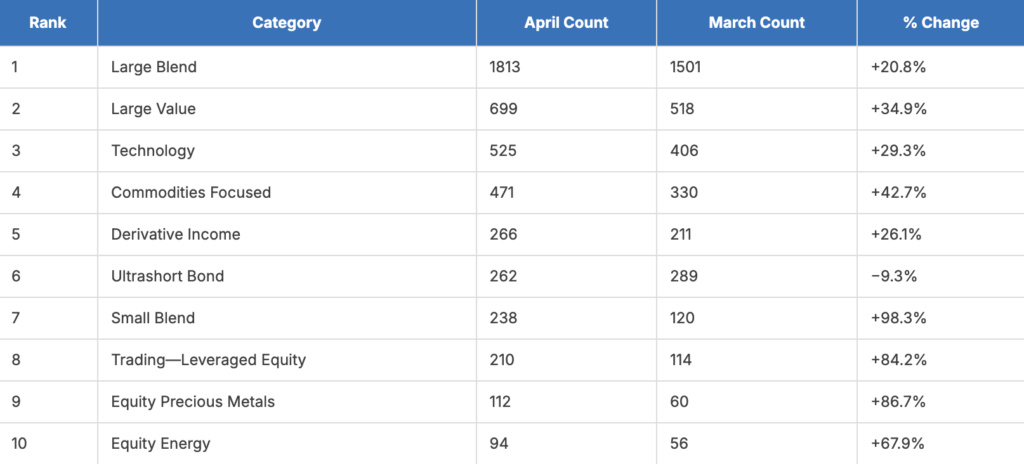

Most-Searched Morningstar Categories – April 2025

Insights:

- Growth in commodities and precious metals categories aligns with increased advisor attention to inflation risks and market volatility

- Tactical ETF categories gained traction as advisors explored hedging and speculative strategies

- Large Value and Technology may reflect interest in sectors with exposure to global trade, cost pressure, or reshoring

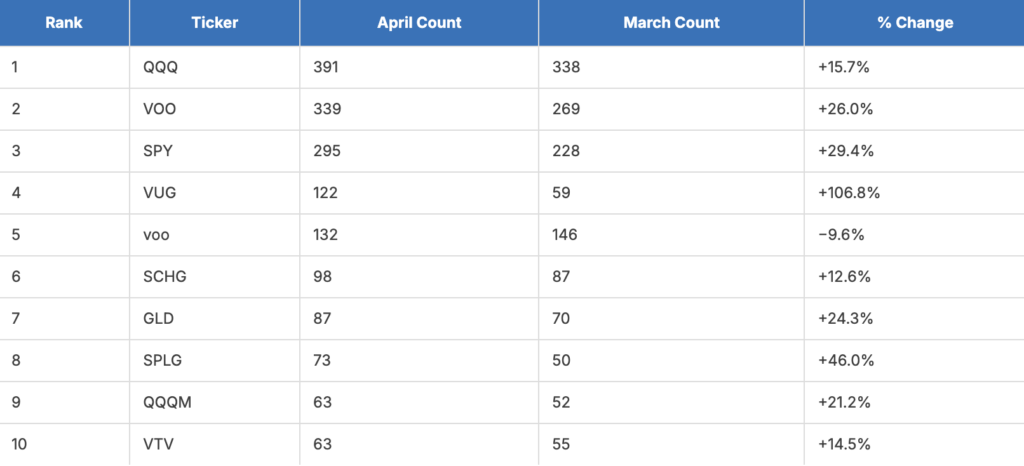

Top-Searched ETF Tickers (Ranked by April Count)

Insights:

- QQQ, VOO, and SPY remained top benchmarks in advisor searches

- GLD saw a notable increase in interest, consistent with the broader focus on gold and real assets

- VUG’s search volume more than doubled, reflecting attention to growth equities during a period of economic uncertainty

- Interest in SPLG and QQQM points to cost-aware evaluation of alternative core exposures

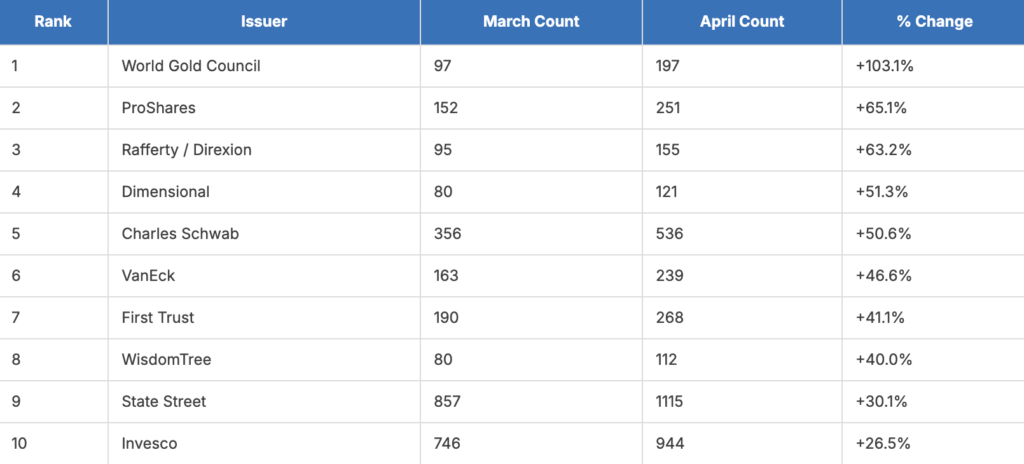

ETF Issuers with the Highest Search Growth

Insights:

- Search growth for World Gold Council, ProShares, and Direxion aligns with increased advisor interest in gold and tactical ETFs

- Broader issuers like Schwab, VanEck, and Dimensional also saw increased visibility, reflecting more diversified search behavior across product types

- State Street and Invesco maintained high search volume as advisors revisited large, core ETF providers

Conclusion

April’s advisor search activity pointed to growing interest in inflation-sensitive assets, sector-specific positioning, and tactical trading strategies—particularly in response to the tariff announcement and associated macro themes.

While search behavior doesn’t directly indicate flows, it provides a useful signal of shifting advisor priorities—supporting better timing and messaging for product, distribution, and marketing teams.

More Blog Posts

- Advisor Moves – April 2025Advisor Moves April 2025 reveals LPL Financial leading advisor inflows, J.P. Morgan Securities topping outflows, and boutique firms like Victory Capital posting the strongest net gains amid a dynamic advisor mobility landscape. […]

- RIA Custodian Trends Report 2025The AdvizorPro 2025 RIA Custodian Trends Report analyzes Form ADV filings to reveal the fastest-growing custodians, platform shifts, and multi-custodial adoption patterns across RIAs by AUM, firm age, and new registrations. […]

- AdvizorPro vs. Traditional Data Platforms: Why AI-Driven Intelligence WinsAdvizorPro replaces outdated, manual data platforms with a real-time, AI-driven intelligence engine that transforms fragmented RIA and family office data into actionable insights—helping teams prospect faster, smarter, and at scale. […]

- TrafficIQ Marketing PlaybookTrafficIQ Playbook: A Guide for Marketing Teams to […]

- Advisor Movement Trends Report 2025Over the past six months, advisor movement was marked by a strong shift toward RIA and hybrid platforms, with nearly half of all transitions driven by younger advisors under 40 and new talent concentrated among a handful of large firms. […]