As tax season approached and markets remained volatile, March saw a notable reshuffling of advisor talent—especially across wirehouses and hybrid platforms. Using AdvizorPro’s proprietary tracking, we identified the firms with the most significant advisor inflows and outflows last month.

Here’s what stood out:

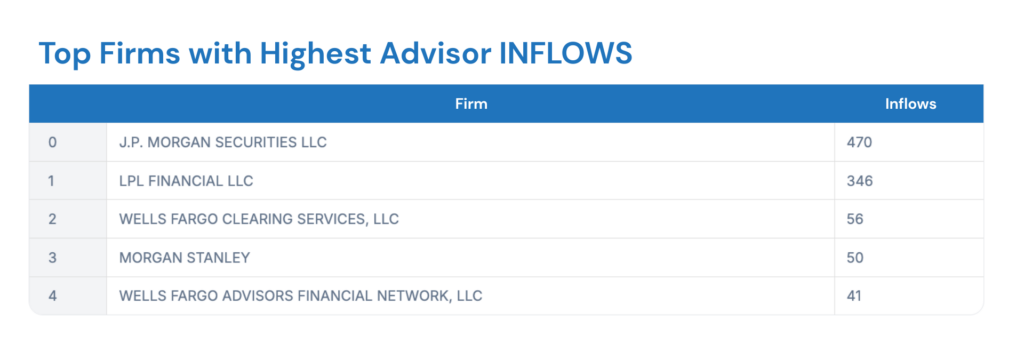

- J.P. Morgan Securities led March with 470 new advisors, signaling growth in its retail brokerage unit—even as its Private Wealth arm saw steep losses.

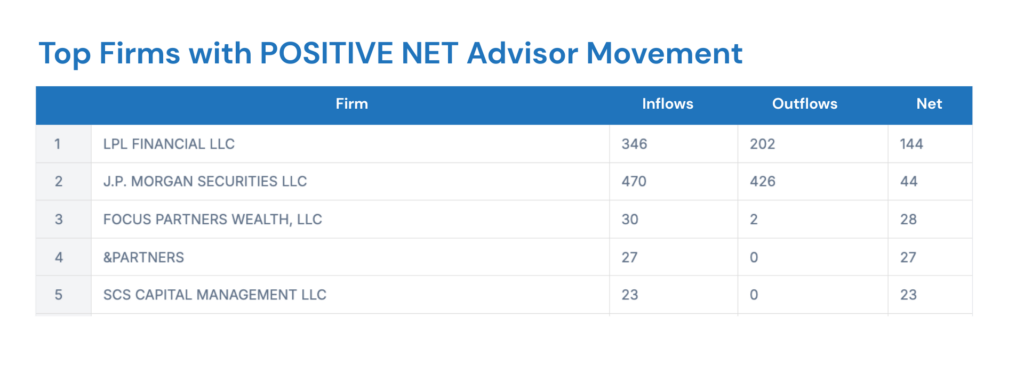

- LPL Financial continued its dominance with 346 net new advisors, highlighting its appeal to wirehouse breakaways and independents seeking flexibility.

- Both Wells Fargo channels and Morgan Stanley showed steady inflows, likely driven by targeted recruiting and platform investments.

- J.P. Morgan appears twice on the list, with both its Securities and Private Wealth arms experiencing elevated turnover—suggesting internal reshuffling or rep segmentation strategy shifts.

- Merrill Lynch continues to see outflows, reflecting persistent pressure from both independent and hybrid platforms.

- Wells Fargo Clearing Services and LPL Financial also posted 200+ exits—underscoring the ongoing churn that can come with aggressive recruiting and advisor re-platforming.

- J.P. Morgan Private Wealth recorded the largest net advisor loss in March, with 368 exits and no reported inflows.

- Merrill Lynch saw 246 advisor departures, keeping it among the top firms for outflows in March—even as the firm has focused on advisor retention initiatives in recent years.

- Fidelity Brokerage Services and Wells Fargo Clearing both posted significant net losses, reinforcing continued movement out of traditional brokerage channels.

- BofA Securities also saw over 140 net departures, signaling that turnover pressure isn’t limited to one segment of the Bank of America advisor network.

Want to track advisor movement in real time, by channel, firm type, or geography?

Book a demo to see how AdvizorPro helps firms stay ahead of advisor transitions.

Author:

Cole Cummings

Growth Marketing Manager

More Blog Posts

- AdvizorPro Mid-Year Growth Update 2025Discover how AdvizorPro scaled its platform, data, and team in the first half of 2025—highlighting major product launches like TrafficIQ, expanded family office coverage, and the release of LinkedIn Connections […]

- LinkedIn Connections: Unlock Warm Intros in AdvizorProAdvizorPro’s LinkedIn Connections feature lets you match your LinkedIn network against a verified advisor database to enrich contact data and uncover warm prospecting opportunities. […]

- Advisor Demographics & Team Structures Report 2025Strategic Insights for RIAs, Asset Managers, & WealthTech Firms | Published by AdvizorPro […]

- 10 Smart Ways Asset Managers Can Combine AdvizorPro with the New ChatGPT + HubSpot IntegrationDiscover 10 powerful ways asset managers can use the new ChatGPT + HubSpot integration with AdvizorPro to unlock smarter prospecting, faster workflows, and real-time CRM intelligence. […]

- How to Maximize ROI as a Wealth Management Conference SponsorA Tactical Playbook for Asset Managers, WealthTechs & Event Exhibitors […]