Advisor Moves - March 2025

.avif)

.avif)

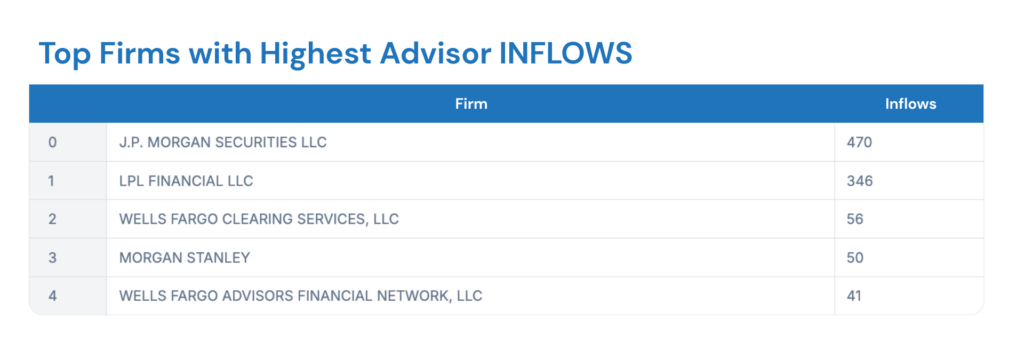

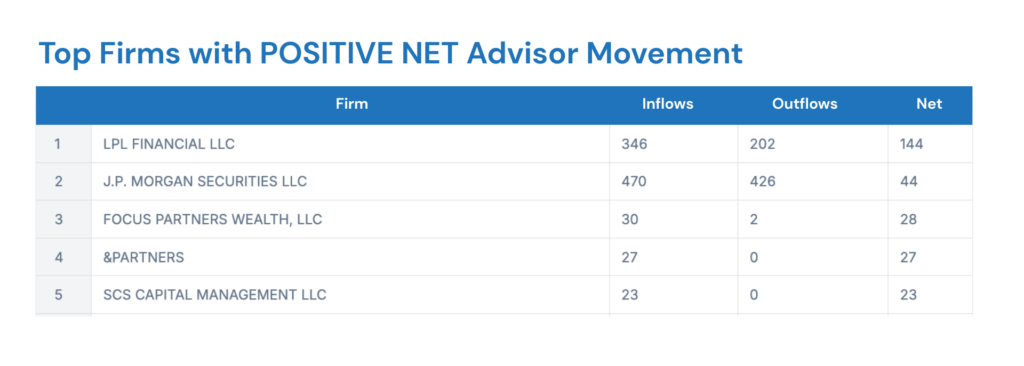

As tax season approached and markets remained volatile, March saw a notable reshuffling of advisor talent, especially across wirehouses and hybrid platforms. Using AdvizorPro’s proprietary tracking, we identified the firms with the most significant advisor inflows and outflows last month.

Here’s what stood out:

- J.P. Morgan Securities led March with 470 new advisors, signaling growth in its retail brokerage unit, even as its Private Wealth arm saw steep losses.

- LPL Financial continued its dominance with 346 net new advisors, highlighting its appeal to wirehouse breakaways and independents seeking flexibility.

- Both Wells Fargo channels and Morgan Stanley showed steady inflows, likely driven by targeted recruiting and platform investments.

- J.P. Morgan appears twice on the list, with both its Securities and Private Wealth arms experiencing elevated turnover, suggesting internal reshuffling or rep segmentation strategy shifts.

- Merrill Lynch continues to see outflows, reflecting persistent pressure from both independent and hybrid platforms.

- Wells Fargo Clearing Services and LPL Financial also posted 200+ exits, underscoring the ongoing churn that can come with aggressive recruiting and advisor re-platforming.

- J.P. Morgan Private Wealth recorded the largest net advisor loss in March, with 368 exits and no reported inflows.

- Merrill Lynch saw 246 advisor departures, keeping it among the top firms for outflows in March, even as the firm has focused on advisor retention initiatives in recent years.

- Fidelity Brokerage Services and Wells Fargo Clearing both posted significant net losses, reinforcing continued movement out of traditional brokerage channels.

- BofA Securities also saw over 140 net departures, signaling that turnover pressure isn't limited to one segment of the Bank of America advisor network.

Advisor Movement Trends: What It Means for 2025

Advisor transitions continue to reshape the wealth management landscape. Independent platforms and hybrid models are gaining traction, while large broker-dealers face persistent pressure to modernize their offerings.

In our recent Advisor Movement Trends Report 2025, we explored how recruiting strategies, compensation changes, and technology adoption are driving this shift. Meanwhile, our Top Independent RIAs of 2025 ranking shows where many of these advisors are heading.

These insights underscore the value of real-time intelligence for tracking advisor transitions—and how staying ahead of the data can reveal emerging growth opportunities across every channel.

Want to track advisor movement in real time by firm type, channel, or geography? Start your free trial today.

Related Post

Related insights you may find valuable

.avif)

.avif)

.avif)