AdvizorPro 2025 RIA Custodian Trends Report

Produced by the AdvizorPro Research Team

Contents

Executive Summary

Methodology & Scope

Market Leaders: Top 10 Custodians

Fastest-Growing Custodians

Custodian Switch Patterns

Multi-Custodial Adoption & Pairings

Trends by RIA AUM Tier

Custodian Adoption by Firm Age

New RIA Preferences

1. Executive Summary

The AdvizorPro 2025 SMA Custodian Trends Report offers proprietary insights from our in-house research team, based on year-over-year analysis of over 23,000 SEC-registered RIAs via section 5 of the Form ADV filings. The report tracks platform usage patterns, firm-level shifts, and broader custody market dynamics.

For custodians, asset managers, RIAs, and wealthtech platforms, this report provides tactical intelligence to guide strategy, product development, and distribution planning.

Key Findings:

Schwab remains the industry anchor, offering trust and scale at a time when many advisors are wary of operational risk. Its dominance in every AUM and firm age segment reflects a powerful brand and a successful TD Ameritrade integration strategy. Schwab’s continued investment in advisor tech (e.g. updates to Schwab Advisor Center) underscores its position as a full-service custodian.

Altruist’s breakout momentum is real and shows no signs of slowing. Its growth isn’t limited to startups anymore—it’s gaining share among mid-sized RIAs as well. As the only venture-backed custodian built specifically for RIAs, Altruist reflects a shift in what firms now expect from their custodians: better technology, easier billing, and stronger integrations. After raising $112M in a Series D in early 2024, the company followed up with a $150M Series F in early 2025, giving it the resources to scale quickly and compete more directly with larger, established platforms.

Diversification is increasing across the board. Nearly 30% of RIAs now use two or more custodians—a defensive posture in a world of tech outages, service bottlenecks, and merger uncertainty. Dual-stack setups (e.g., Schwab + Fidelity or Schwab + Altruist) allow firms to hedge risk while offering clients broader capabilities.

New RIA formation remains healthy, but custodial competition for these relationships is intensifying. Schwab remains the default, but challengers like Altruist and niche players like Interactive Brokers are gaining from firms prioritizing cost control, ease of onboarding, or specialized asset classes.

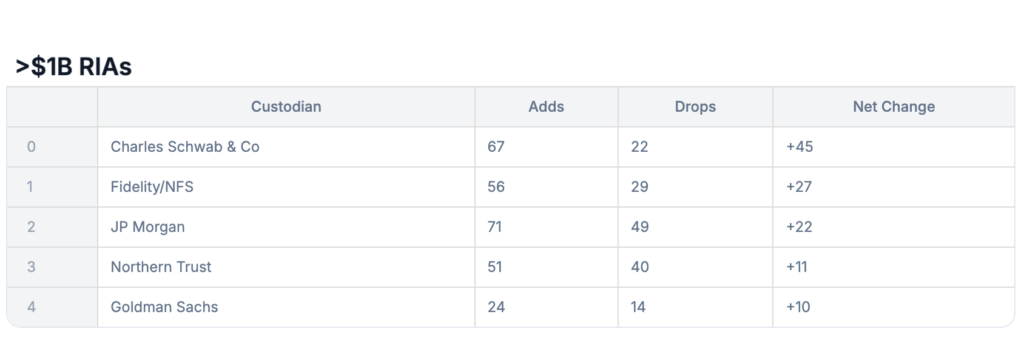

Larger RIAs (> $1B AUM) are increasingly open to banks and premium custodians like JP Morgan and Northern Trust—often driven by UHNW client needs, cash management offerings, and service depth. As private credit and alt exposure grows, these firms may further pivot toward custodians who can handle complex assets.

2. Methodology & Scope

This report is based on analysis of Form ADV data filed annually by SEC-registered RIAs. By regulatory requirement, firms must update their Form ADV filings by March 31 each year. To ensure consistency and completeness, we conducted data extracts for both the 2024 and 2025 reporting cycles in early April, immediately following the filing deadline.

Our analysis tracks year-over-year changes in SMA custodian relationships across over 23,000 RIAs. Each relationship was categorized as retained, added, or terminated, and segmented by firm size (AUM) and age (firm tenure).

Key Metrics:

27,394 custodian relationships retained

4,025 new relationships added

2,329 relationships terminated

RIAs using multiple custodians rose from 5,938 to 6,253

These shifts reflect a stable but evolving custodial market—shaped by consolidation among incumbents and rising adoption of modern, tech-forward platforms.

Note: While TD Ameritrade was officially acquired by Charles Schwab in 2020 and final account transitions occurred September of 2023, many RIAs continued to list TD Ameritrade as a distinct custodian on their Form ADV filings through early 2025. For the purposes of this report, TD Ameritrade and Schwab are analyzed separately where RIAs explicitly named both. However, Schwab’s continued growth reflects the migration of these relationships.

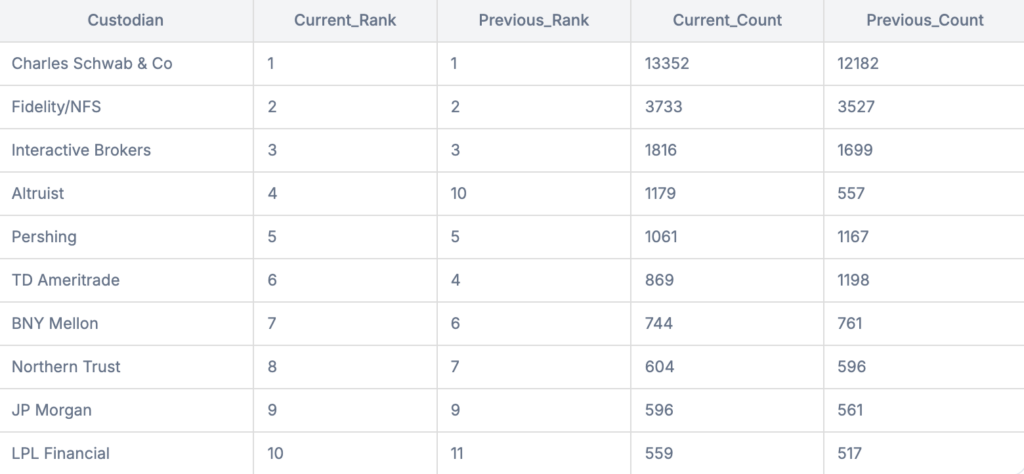

3. Market Leaders: Top 10 Custodians

This section ranks the most widely used SMA custodians by number of RIA relationships, showing how market share has shifted year-over-year. It highlights which platforms remain dominant and which are climbing the ranks, with context around acquisition activity and evolving platform preferences.TD Ameritrade dropped from #4 to #6, as more RIAs updated ADVs Schwab post-acquisition. This decline is expected to continue until fully listed as Schwab.

Key Takeaways:

Altruist’s ascent: Jumping from #10 to #4, Altruist’s rise underscores the industry’s shift towards digital-first custodial solutions. This growth aligns with the broader trend of RIAs seeking streamlined, tech-driven platforms to meet evolving client expectations.

Schwab’s dominance: Maintaining the top spot, Charles Schwab’s continued growth reflects successful integration strategies and a focus on comprehensive service offerings that resonate with a broad RIA audience.

TD Ameritrade’s decline: The decrease in TD Ameritrade’s relationships is a direct result of Schwab’s acquisition and consolidation efforts, illustrating the impact of M&A activities on custodian rankings.

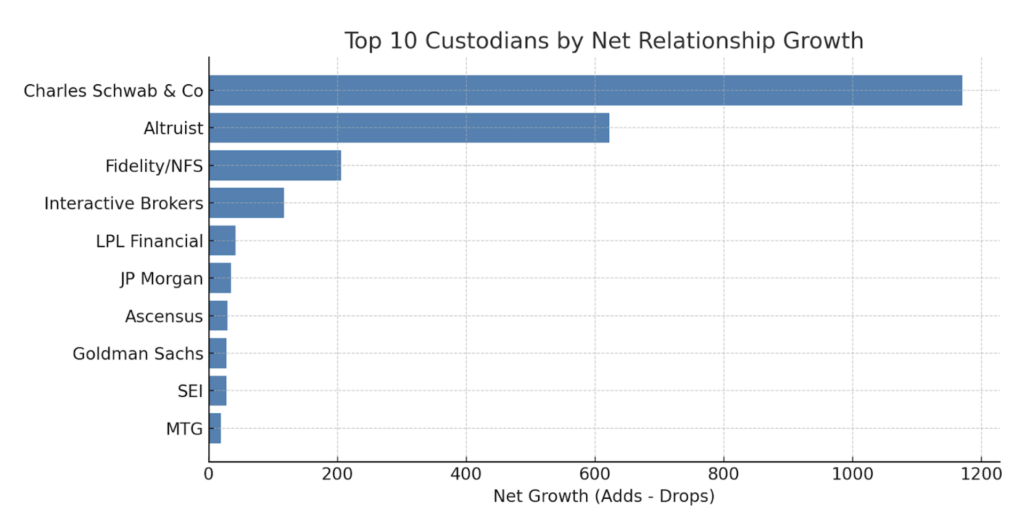

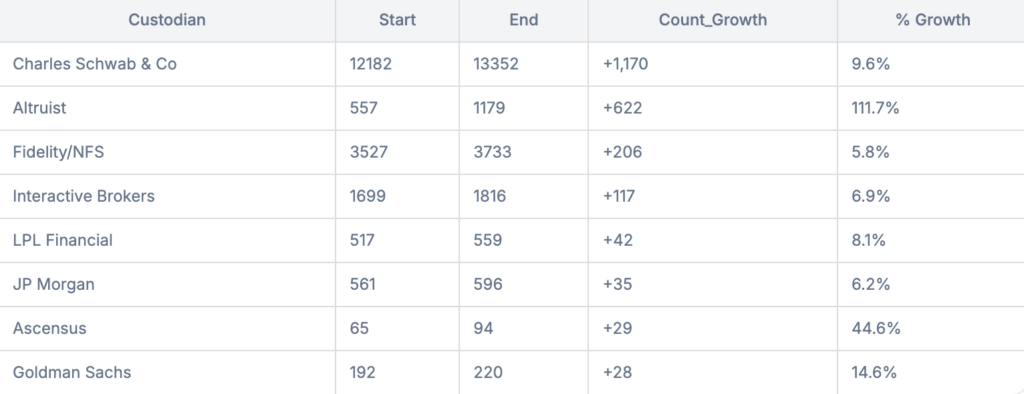

4. Fastest-Growing Custodians

Focusing on momentum, this section identifies custodians experiencing the greatest net growth in RIA relationships. It offers insight into emerging players, challenger platforms, and which incumbents are successfully expanding their footprint.

Key Takeaways:

Altruist’s rapid growth: With a 111.7% increase, Altruist’s expansion is indicative of RIAs’ growing preference for custodians that offer integrated technology solutions, aligning with the industry’s digital transformation.

Schwab’s steady increase: Schwab’s growth reflects its ability to retain and attract RIAs through a combination of robust service offerings and the successful integration of TD Ameritrade’s client base.

Emerging players: The notable growth of mid-sized custodians like Ascensus and Goldman Sachs suggests a diversification in RIA preferences, potentially driven by specialized services and niche offerings.

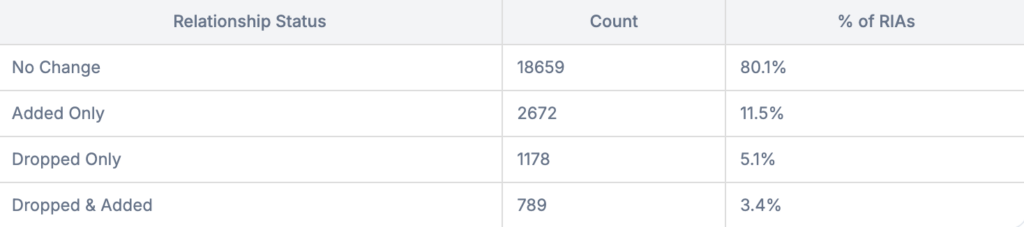

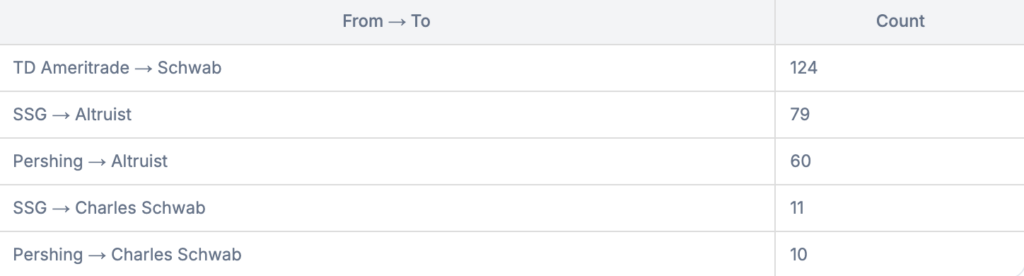

5. Custodian Switch Patterns

This section examines retention and switching dynamics among RIAs, breaking down how many kept, added, or dropped custodial relationships. It also surfaces the most common platform switches—offering a snapshot of competitive churn and brand consolidation.

Insights:

Schwab’s consolidation: The significant number of transitions from TD Ameritrade to Schwab highlights the ongoing consolidation in the custodial space and Schwab’s strategic positioning post-acquisition.

Altruist attracting traditional clients: The movement from established custodians like SSG and Pershing to Altruist indicates a shift in RIA preferences towards platforms that offer modern, technology-driven solutions.

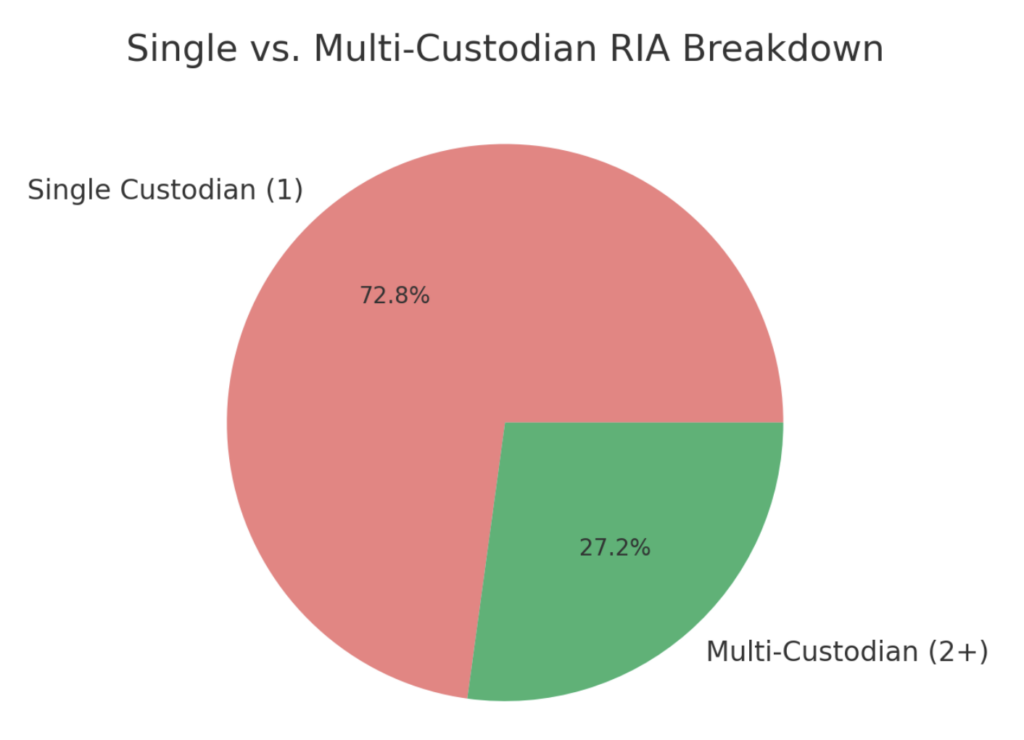

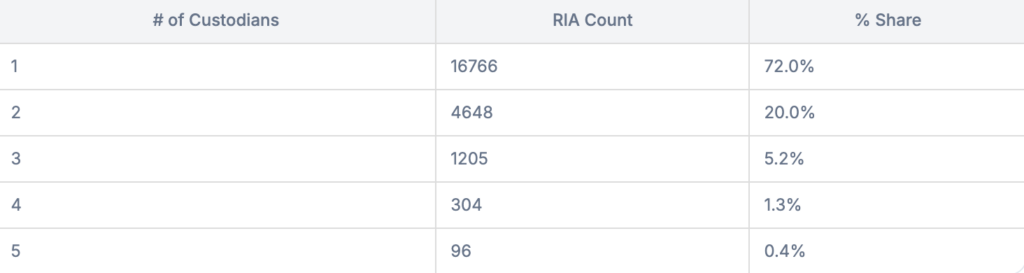

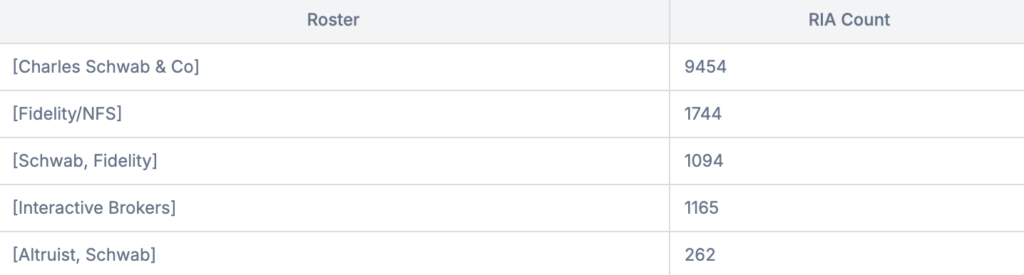

6. Multi-Custodial Adoption & Pairings

RIAs are increasingly choosing to work with multiple custodians. This section quantifies how prevalent multi-custodial setups have become and identifies the most common custodian pairings—shedding light on complementary strategies and diversification plays.

RIA Distribution by Custodian Count

Most Common Custodian Rosters

Insights:

Rise in multi-custodial relationships: The increase in RIAs using multiple custodians reflects a strategic approach to diversify service offerings and mitigate risks associated with relying on a single provider.

Popular pairings: The frequent combination of Schwab and Fidelity suggests that RIAs value the complementary strengths of these custodians.

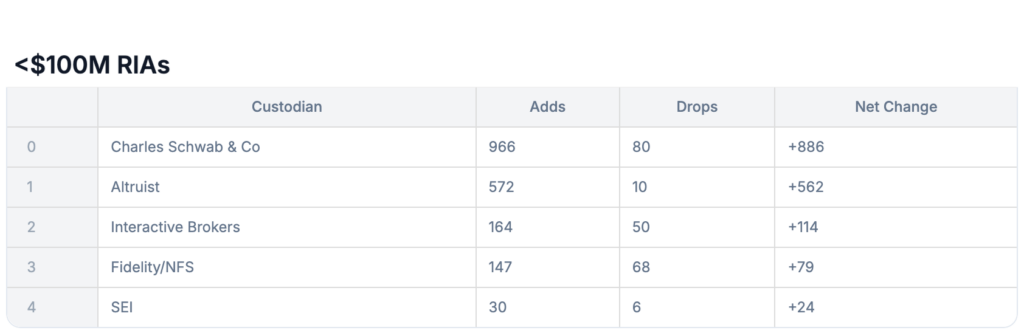

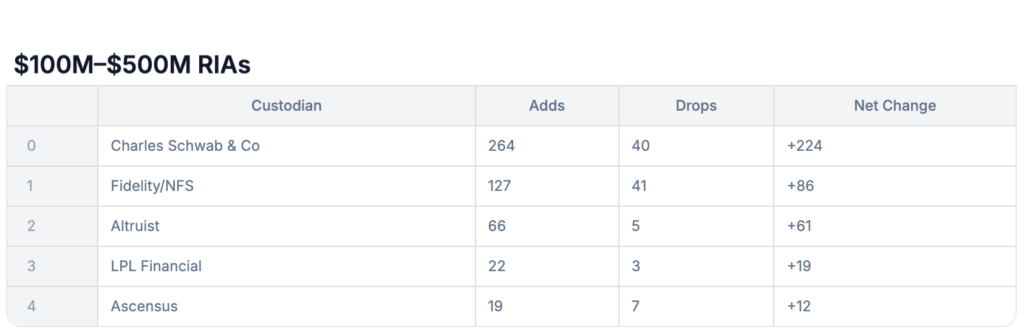

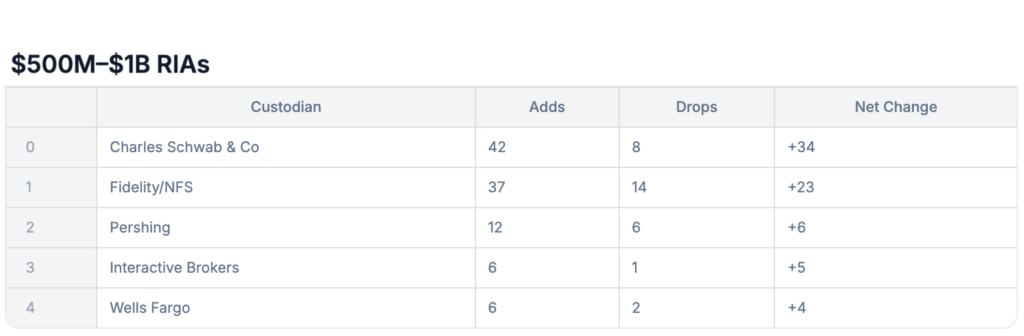

7. Trends by RIA AUM Tier

Custodian preferences often correlate with firm size. This section segments the data into four AUM tiers to explore which custodians are gaining (or losing) traction in small, mid-sized, and large RIAs—and how platform fit differs by scale.

Insights:

Schwab’s Consistent Leadership: Across all AUM tiers, Charles Schwab & Co. maintains a leading position, reflecting its broad appeal and comprehensive service offerings that cater to a diverse range of RIAs.

Altruist’s Emergence in Lower Tiers: Altruist’s significant net gains in the <$500M segments underscore its growing traction among smaller and mid-sized RIAs seeking modern, cost-effective custodial solutions.

Diversification Among Larger RIAs: Firms with >$1B AUM exhibit a more diversified custodian usage, with institutions like JP Morgan, Northern Trust, and Goldman Sachs gaining footholds, indicating a preference for specialized services and premium relationships.

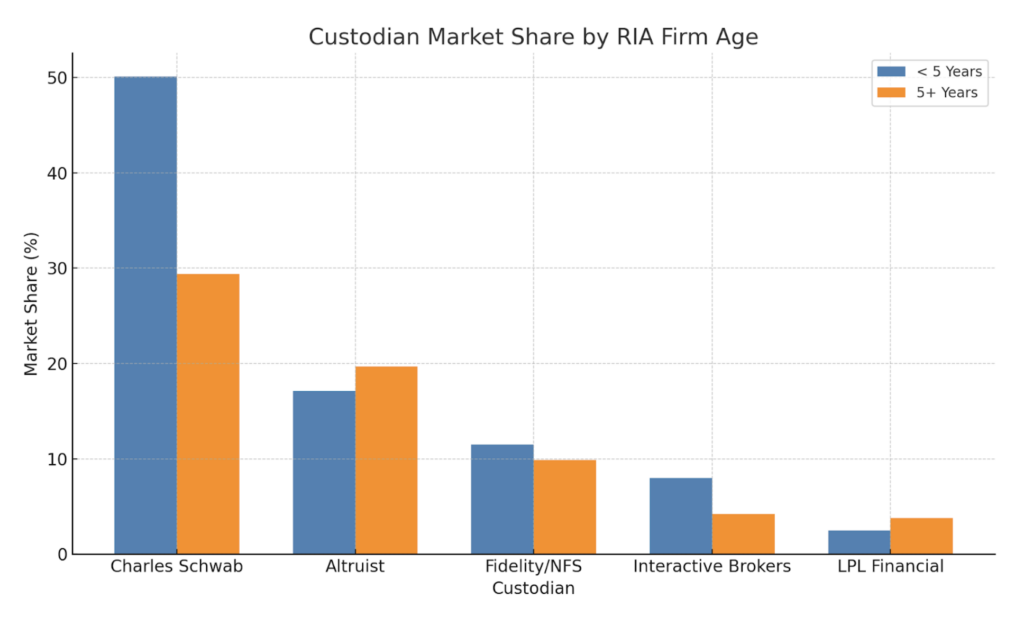

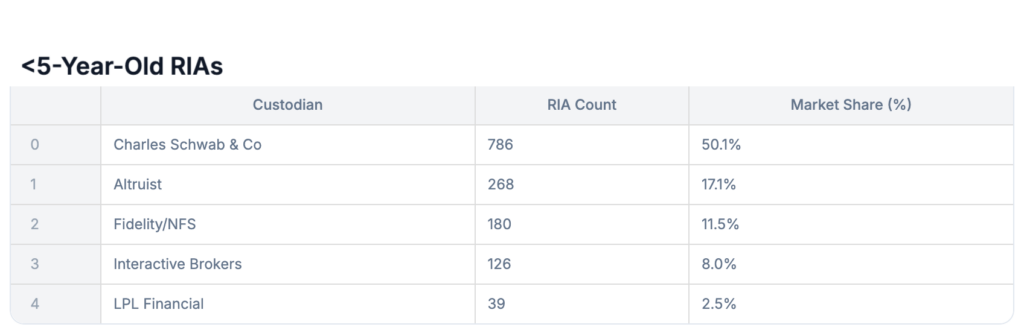

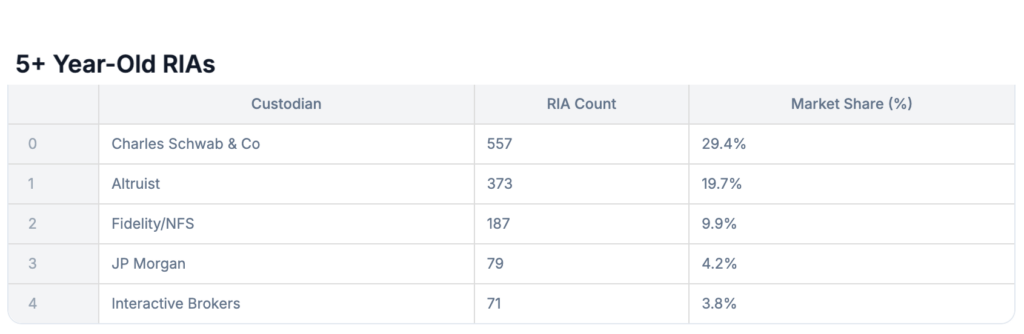

8. Custodian Adoption by Firm Age

Firm tenure is another key driver of custodial decisions. In this section, we compare custodian usage between newer RIAs (<5 years old) and established firms (5+ years), offering insight into generational platform preferences and legacy relationships.

Insights:

Schwab’s Broad Appeal: Charles Schwab & Co. leads in both age cohorts, proving its strong brand recognition and deep ecosystem that resonate with both new and established RIAs.

Altruist’s Rising Popularity: Altruist’s notable market share among newer firms highlights its appeal to RIAs seeking modern, technology-driven custodial solutions.

Diverse Preferences Among Established RIAs: Older firms show a more diversified custodian usage, with traditional institutions like JP Morgan gaining visibility, reflecting legacy relationships and the need for deeper integration services.

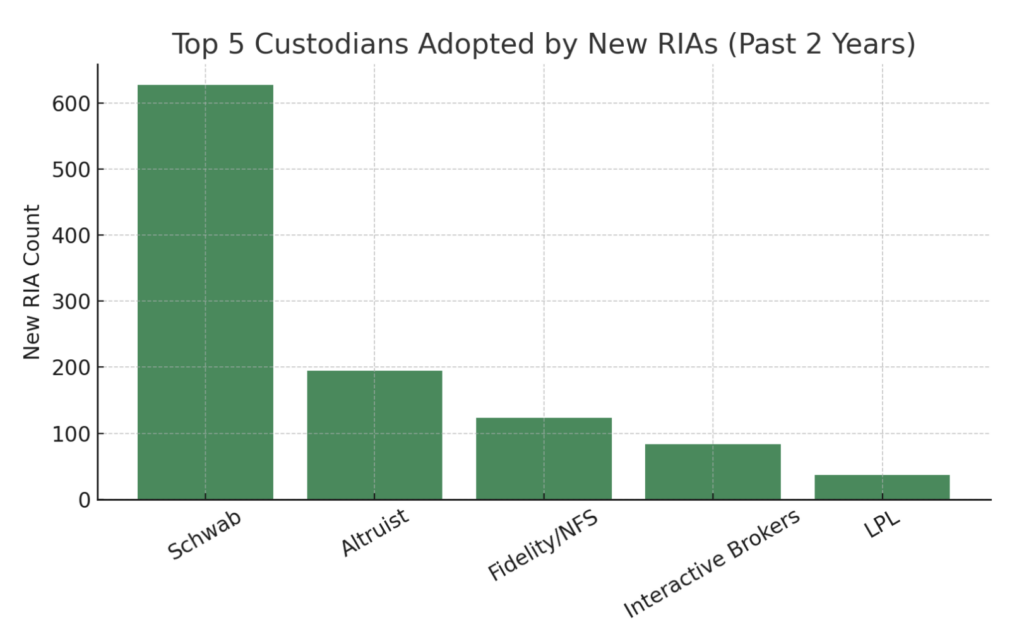

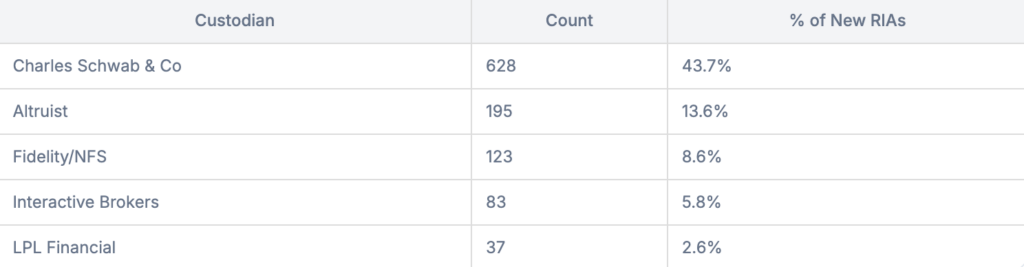

9. New RIA Preferences

This section isolates custodians most commonly selected by newly registered RIAs. It provides a forward-looking view of market momentum and highlights which platforms are winning the first relationship when a new firm is launched.

Insights:

Schwab’s Dominance Among New Entrants: Charles Schwab & Co.’s significant share among newly registered RIAs underscores its strong brand presence and comprehensive offerings that appeal to new firms.

Altruist’s Appeal to Digital-First Firms: Altruist’s substantial share among new RIAs indicates its resonance with firms prioritizing digital solutions and streamlined operations.

Interactive Brokers’ Niche Positioning: Interactive Brokers’ presence among new RIAs suggests its appeal to cost-sensitive firms and those seeking robust trading capabilities.

About This Report

This report was produced by the AdvizorPro Research Team using proprietary parsing and standardization of Form ADV filings submitted to the SEC. We analyze tens of thousands of SMA custodian relationships annually across firm size, age, and behavior patterns to help our clients—custodians, asset managers, tech platforms, and recruiters—understand who’s winning, who’s growing, and where the market is headed next.