Find & Win More RIA & Family Office Clients

Built on Verified Data + Advanced AI Intelligence

The trusted platform for asset managers, wealthtechs, and recruiters who need to identify, target, and convert high-value advisors and family offices - powered by smarter, cleaner data.

Your Competitive Edge in Smarter Wealth-Channel Growth

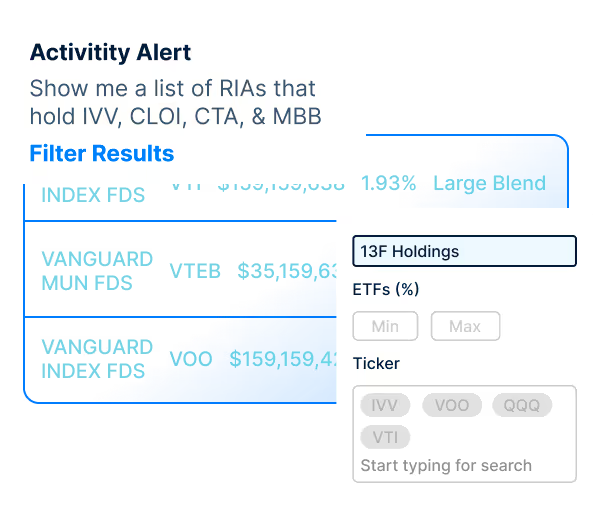

Identify Advisors Actively Allocating Capital

Surface RIAs, family offices, and broker-dealers increasing ETF, SMA, or private-alts exposure - powered by verified data, behavioral cues, and intent signals. Focus distribution on firms most likely to add your products.

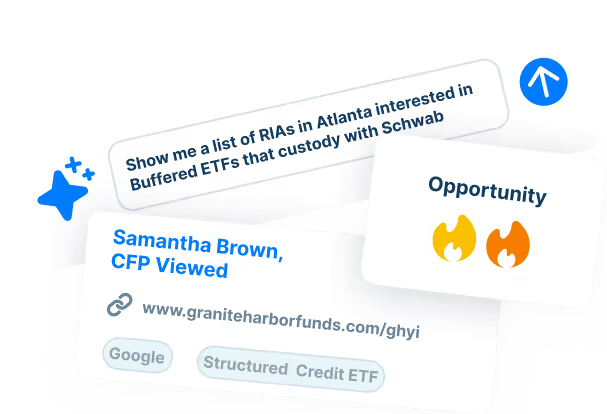

Turn Advisor Interest Into Measurable Growth

Reveal wealth advisors and family offices engaging with your site or brand - and route them into your team for timely follow-up and action.

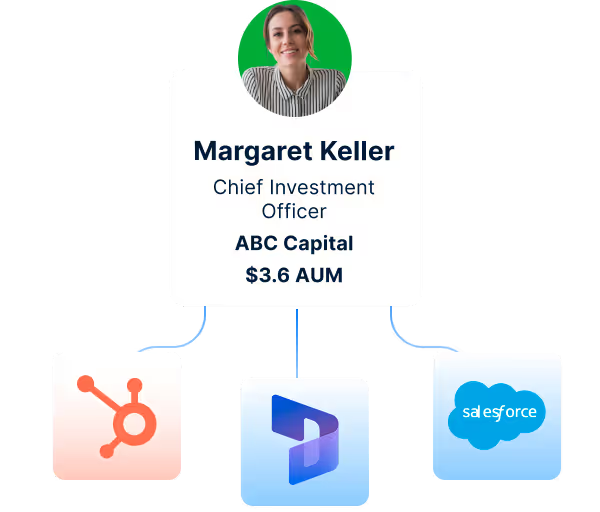

Equip Your Team With Clean, Connected Intelligence

Sync verified advisor and firm data directly into your CRM - including AUM, custodian, tech stack, and product exposure - so distribution, marketing, and recruiting teams can target the right firms and personalize every interaction.

See the Complete Story Behind Every Firm & Team

Understand firm hierarchy, AUM bands, tech stack, product exposure, and investment focus - helping your distribution, marketing, and recruiting teams prioritize the right relationships.

See How AdvizorPro Fuels Revenue Growth Across the Wealth Channel

.svg)

Everything You Need to Accelerate Growth - All in One Platform

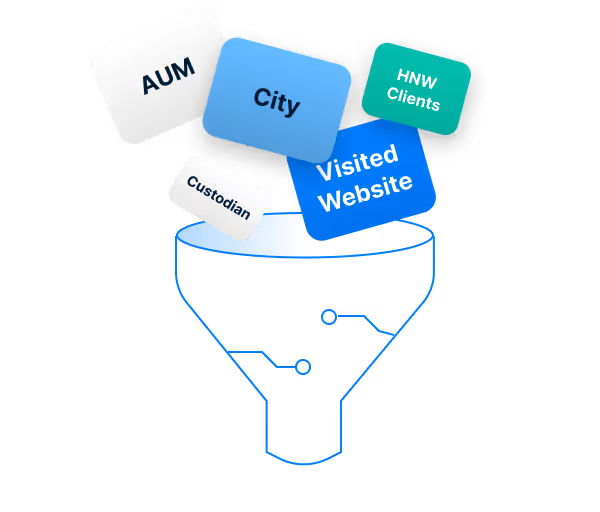

Precision Prospecting

Target the right RIAs, family offices, and broker-dealers in seconds - with precision filters that surface high-fit firms and decision-makers ready to engage.

Turn Website Visitors Into Pipeline

Reveal which RIAs, family offices, and wealth firms are engaging with your site - and route them instantly to your CRM for immediate outreach.

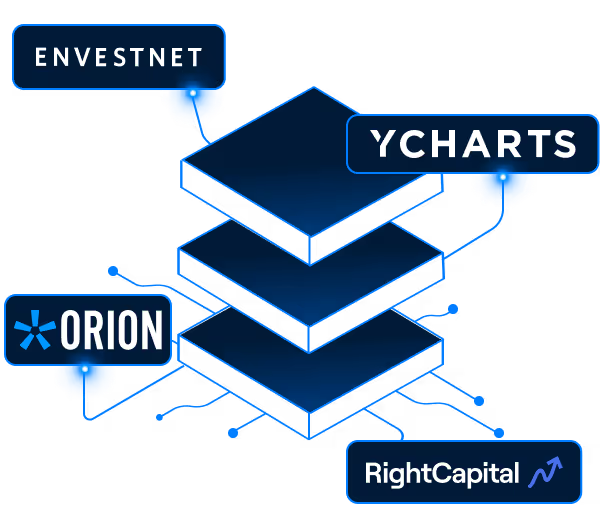

Tech Stack Targeting

Filter RIAs and wealth teams by tech stack - from TAMPs to portfolio systems - to uncover alignment opportunities and tailor your outreach.

CRM Integrations

Push enriched contact and firm profiles directly into Salesforce, HubSpot, or Dynamics - eliminating manual work and powering faster follow-up.

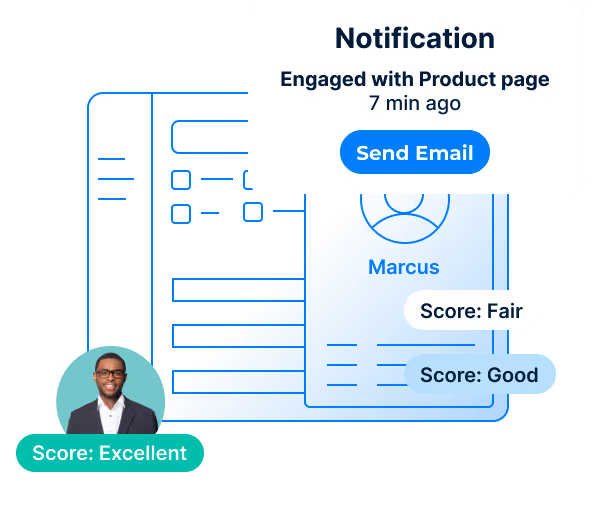

Smart Scoring & AI Insights

Detect buying signals, score leads by fit, and focus your team’s time on the prospects most likely to convert.

Competitive & Holdings Insights

Identify fund flows, allocation gaps, and competitor exposure across RIAs - so you can target advisors positioned to move assets.

Testimonials

View Recent Blog Posts

News, strategies, and real-world examples from across the wealth management and family office industry.

.avif)

.avif)

Own the Wealth Channel With Smarter Prospecting

Identify and prioritize RIAs, family offices, and broker-dealers ready to engage. Convert faster with verified wealth-channel intelligence, integrated CRM workflows, and data that fuels measurable revenue growth.

%20(1).webp)