Find and Win More RIA & Family Office Clients

Built on Verified Data + Advanced AI Intelligence

- 750,000+ Verified RIA and Family Office profiles

- Search and filter by AUM, custodian, and specialization

- The smarter, faster alternative to outdated advisor databases

How AdvizorPro Helps You Find and Win the Right Clients

Search Smarter

Quickly zero in on your ideal prospects using advanced filters by firm size, AUM, platforms, and more.

Verify Instantly

Access accurate, up-to-date data that’s verified and ready for outreach with no guesswork or outdated lists.

Convert with Confidence

Connect with qualified leads and grow your book of business faster with insights you can trust.

AdvizorPro was Built For:

.svg)

Features

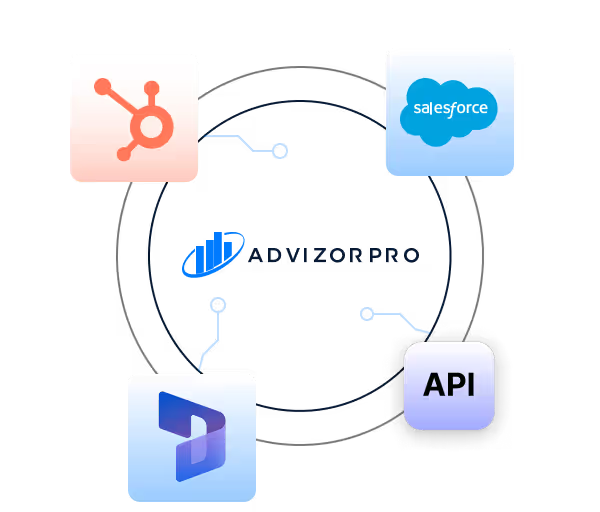

CRM integration

Sync seamlessly with Salesforce, HubSpot, and Dynamics auto-enrich contacts, push smart lists, and power real-time workflows.

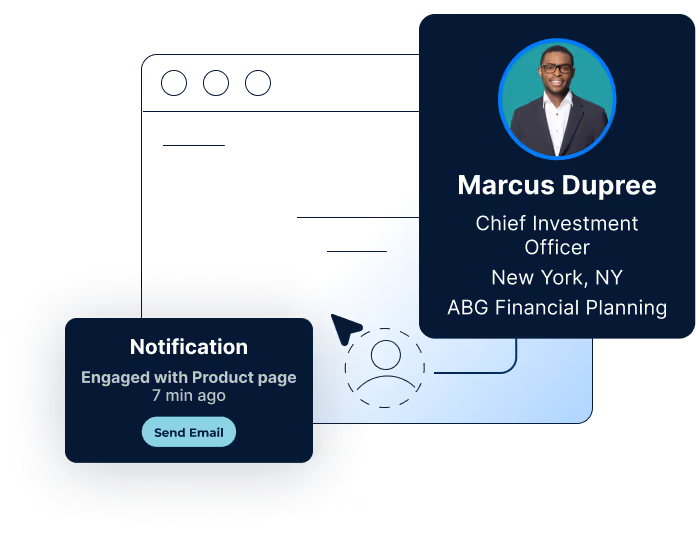

Traffic IQ

Know which RIAs are on your site even before they fill out a form. Turn anonymous traffic into outreach-ready insights that power sales and marketing workflows.

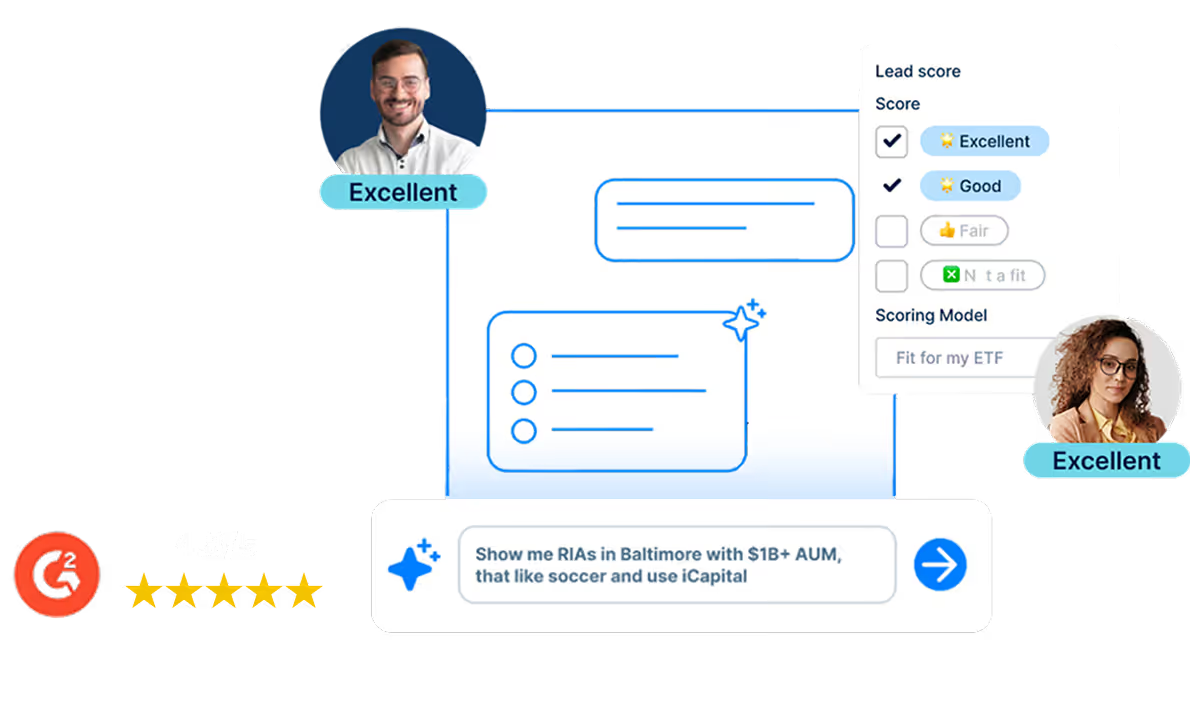

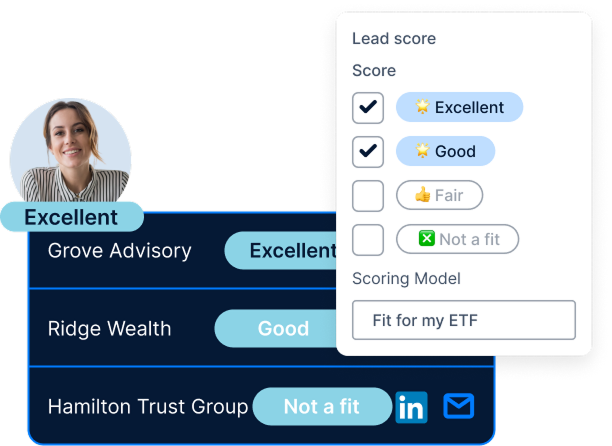

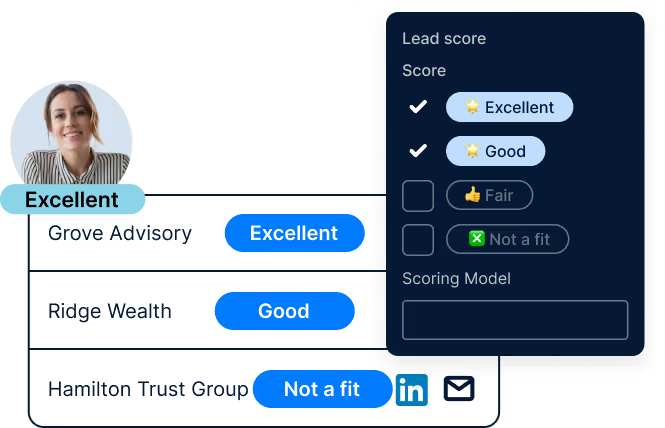

Lead Scoring

Automatically score advisors and firms using location, AUM, custodian, keyword tags, and site visit activity to prioritize best-fit leads.

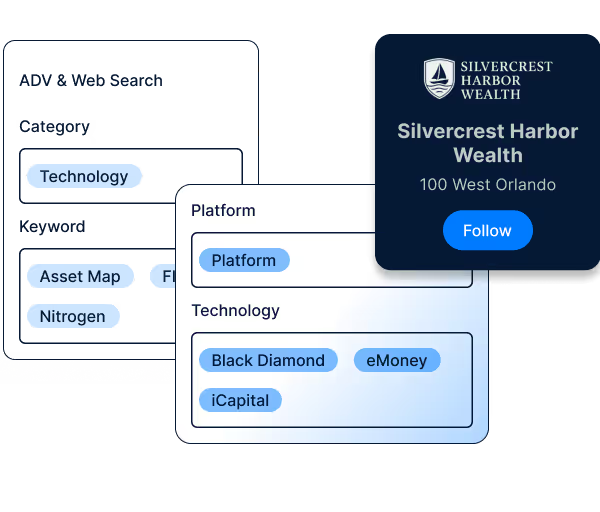

Tech Stack

See which firms use tools like Orion, Envestnet, or eMoney - ideal for wealthtechs identifying RIAs using competitors or asset managers targeting specific platforms.

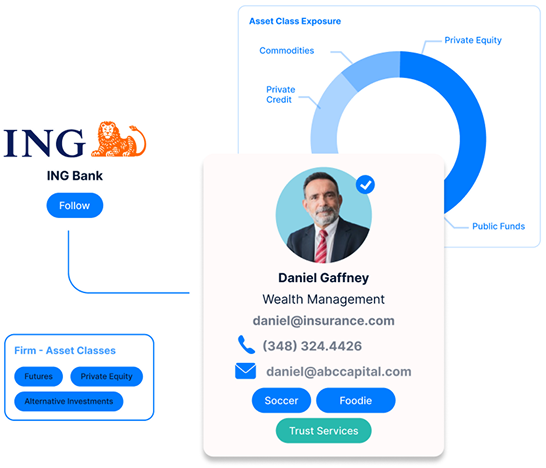

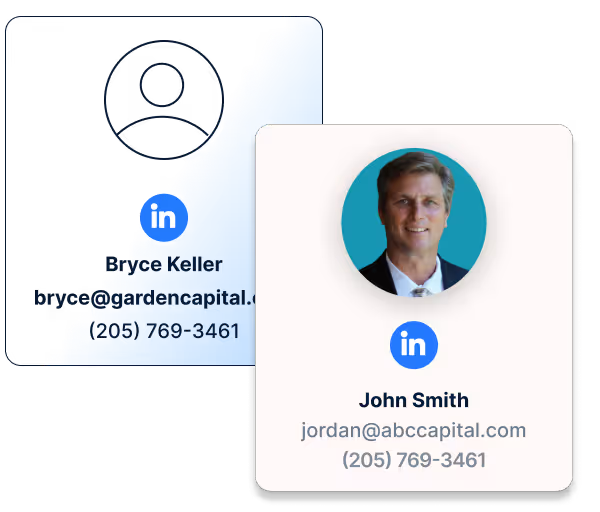

Contact Intelligence

Reach decision-makers across RIAs, family offices, and more with verified titles, emails, and phone numbers at scale.

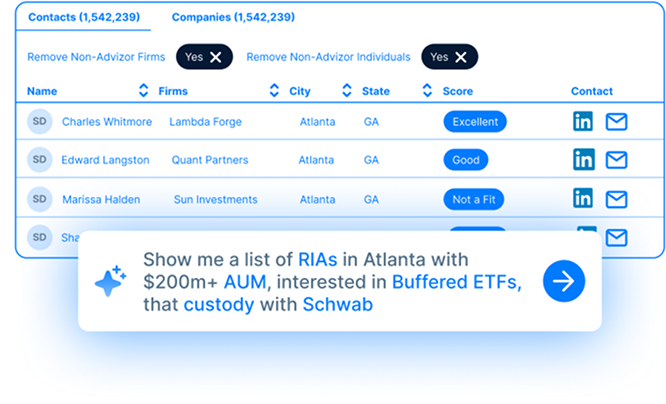

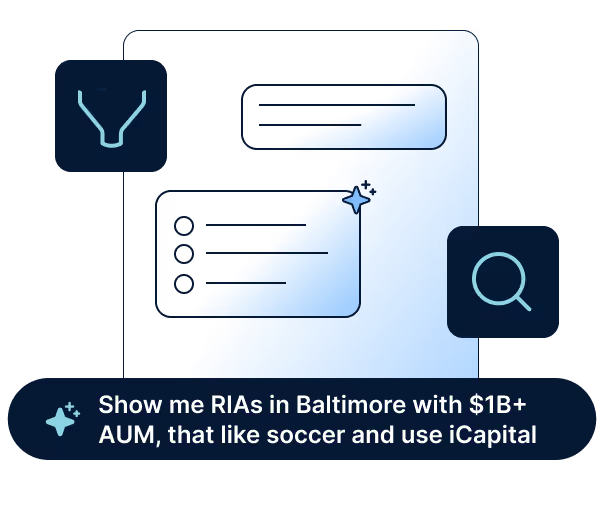

Al Search Assistant

Chat with our in-app AI assistant to run searches using plain English. It builds queries and filters directly in the platform.

Wealth Team Intel

Navigate complex orgs at wirehouses, banks, and large IBDs. With over 25,000 teams mapped, see structure, key contacts, and reporting lines reach the right leaders, not just a name.

List Matching

Upload advisor lists from conferences, webinars, or inbound leads, and match them to enriched profiles with firm data, contact info, scoring, and CRM-ready exports.

.png)

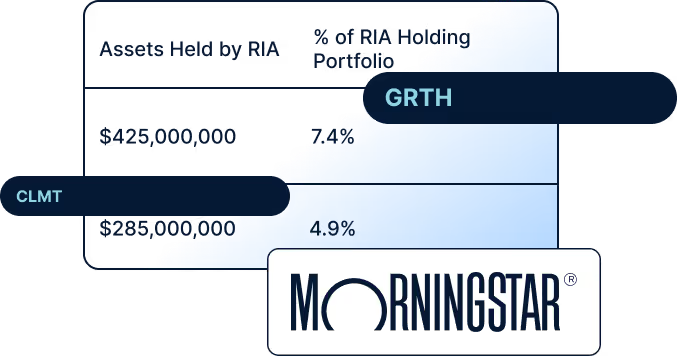

ETF Holdings

See which RIAs hold your competitors’ ETFs or others in the same Morningstar category great for identifying prospects or tracking demand shifts.

How AdvizorPro Turns

RIA Prospects into Clients

Target High-Value RIAs

Our Al surfaces wealth advisors and family offices actually in the market - based on behavior, product interest, and contact/firm-level intent signals. It's smarter targeting, not guesswork.

Turn Website Traffic Into Pipeline

Identify anonymous RIA and family office visitors and push them directly into your workflows-turning passive traffic into warm, high-intent leads your sales and marketing teams can act on immediately.

Activate Your CRM

Turn your CRM into a growth engine. Sync verified advisor data, automate enrichment, and push fresh insights into every field - so your sales and marketing teams act on accurate, up-to-date intelligence every day.

Get Inside the Advisor Mindset

Whether it's ETF holdings, tech stack, TAMP affiliation, hobbies, team structure, or niche focus areas we surface the intel that helps you personalize every message, meeting, and move.

Testimonials

View Recent Blog Posts

News, strategies, and real-world examples from across the wealth management and family office industry.

.avif)

.avif)

Stop wasting time searching.

Start building relationships with the right wealth advisors & family offices

Start Your Free Trial

.webp)