If you’re in the midst of exploring investment CRM options for your investment firm, you likely recognize the incredible value that a well-implemented CRM system can bring to your business.

Well maintained CRMs have the potential to be a game changer for daily operations by saving time and boosting sales, marketing and client service productivity.

At AdvizorPro, we’re staunch advocates of the foundational power of accurate data and have direct native integrations with both Salesforce and HubSpot CRMs.

Having helped numerous clients with their CRM systems and data, we have seen and heard a lot about what works and does not work for a CRM within the investment industry. We’ve compiled a list of top CRM software options. Among these, you’ll find general CRM systems, as well as specialized solutions designed specifically for investment firms. The choice ultimately hinges on your unique investor CRM requirements.

In this blog, we’ll introduce you to 10 leading CRM systems available in the market, shedding light on what each has to offer and how they are priced. Our goal is to equip your team with the knowledge needed to discover the ideal data partners for your investment management needs.

Investment-Specific CRMs

Salesforce, a widely recognized Customer Relationship Management system initially designed for sales teams, focuses on fostering long-term client relationships and seamless transitions. With a strong emphasis on innovation and philanthropy, Salesforce serves as a powerful tool for sales, marketing, and collaboration, catering to diverse business needs and encouraging smart idea sharing. Their system offers limitless applications, adaptations, and opportunities for all your teams, spanning sales, marketing, IT, and customer service, making it a versatile solution.

This flexibility comes with a significant cost as user licenses can range from $75 to hundreds of dollars monthly per user. However, the platform’s adaptability to various company sizes and devices, along with its strong usability and accessibility, has contributed to its popularity among larger organizations.

Microsoft Dynamics, though not as large as Salesforce, has earned widespread respect across various industries, including the financial sector. It is often preferred due to its integration with Microsoft’s Office Suite and Windows OS, leading to increased efficiency for many adopting firms. The pricing structure varies depending on user count and licenses, making it adaptable to diverse business needs. Despite the requirement for training and programming skills, once mastered, Dynamics efficiently streamlines operations, enhances customer interactions, and drives business growth. With its unified ERP and CRM platform, Microsoft Dynamics 365 offers comprehensive insights into sales and marketing performance through intelligent data analysis, powered by AI and machine learning.

Backstop’s Customer Relationship manager was among the initial investment-focused systems introduced to the market. Catering to institutional asset owners and investment managers, Backstop’s core products, including Backstop CRM, Backstop IR, and Backstop Research, provide a centralized database for handling client activities, investment documentation, research materials, and email correspondence. Tailored for foundations, investment consultants, family offices, and pension funds, Backstop provides cloud-based tools to facilitate capital raising, portfolio management, and seamless stakeholder service.

Altvia is a specialized solution tailored to private equity, venture capital, and alternative investment firms. It seamlessly integrates with Salesforce, enabling collaboration among GPs, LPs, and portfolio managers. Users gain access to due diligence support, marketing automation, and portfolio metrics. Although it incorporates AI for insights, it doesn’t emphasize data relationships. While the CRM offers certain custom reporting and data analytics capabilities that minimize manual data entry, users must still rely on manual data input to maintain up to date contact and activity information.

For the past decade, DealCloud CRM has served the private equity, real estate, and venture capital sectors as a flexible SaaS solution designed specifically for capital market dealmakers. Its customizable platform enables seamless deal flow management, relationship nurturing, and efficient firm administration. DealCloud fosters business modernization through streamlined processes, detailed analytics, and a unified data source, facilitated by seamless integration with external solutions and third-party data providers.

Sales Page is a system enabling asset managers to utilize data in aligning investment products with the most suitable clients. It also facilitates effective data management and reporting, aiding in goal achievement, while seamlessly integrating with your existing business systems. Furthermore, SalesPage Financial provides tailored solutions, regularly conducting consultations and online training to ensure increased profitability for its clientele, making it a preferred choice in the financial industry.

Satuit CRM is designed for the asset management industry. It provides specialized tools and features tailored to the unique needs of asset managers, helping them streamline client management, enhance relationships, and improve overall operational efficiency. The platform typically offers functionalities such as client reporting, contact management, marketing automation, and performance analysis, among others, specific to the requirements of asset management firms. Additionally, Satuit provides a variety of products and solutions, empowering your firm to select the most suitable option for your needs.

Other general CRMs to consider

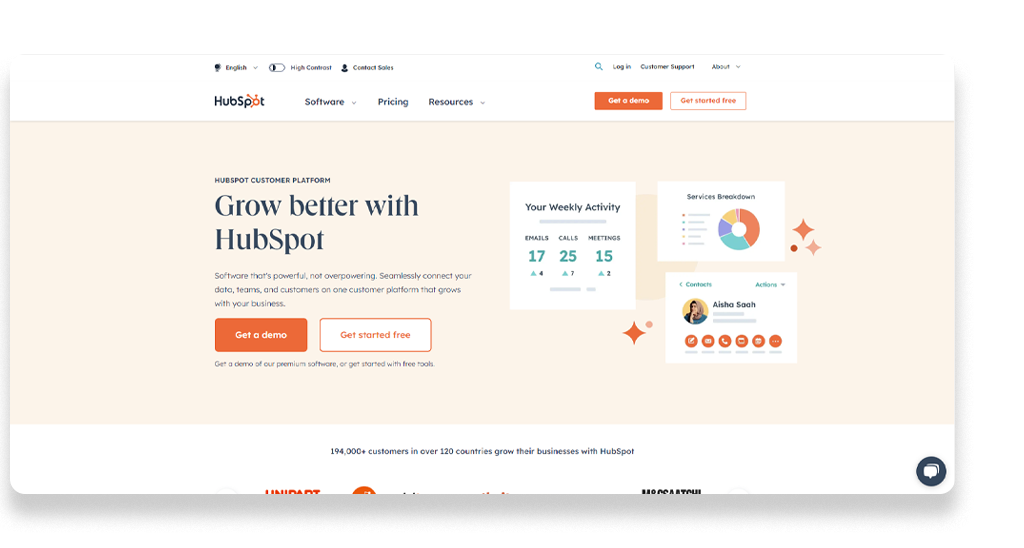

HubSpot is known for its CRM and inbound marketing expertise and offers a comprehensive software suite that caters to various business needs, encompassing marketing, sales, and customer service. Its sales CRM tool provides a range of features, including customizable deal stages, email tracking and templates, and integration with various platforms like Gmail, Google Calendar, Outlook, Facebook, Twitter, and LinkedIn. The CRM can be customized for investor relations, supported by 20 customizable apps and various integration options.

Despite not being specialized for investor relationship management, the Zoho CRM system automation capabilities and customizable interface contribute to effective investor communication and streamlined processes. Supporting multiple languages and remote work, Zoho CRM integrates with Gmail, Twitter, Slack, and WordPress, catering to diverse business needs without compromising quality. The platform provides a free version for newcomers to familiarize themselves with its capabilities, alongside more advanced paid options tailored to various business sizes and requirements.

Pipedrive emphasizes sales and marketing while facilitating deal tracking and pipeline management in three simple steps. It offers a 14-day free trial with full access, a customizable sales pipeline, revenue forecasts, integration with over 300 tools, and round-the-clock customer service. With Pipedrive’s seamless third-party integration, you can effectively streamline investor relations processes during the trial period, even though the CRM isn’t specifically tailored for this purpose. While focusing on activity-based selling, Pipedrive offers various pricing options, ranging from $12.50 to $99.00 per user per month, catering to businesses of all sizes.

Which CRM is right for you?

As you finish this CRM list, you may find yourself contemplating the next steps in your CRM journey. It’s important to remember that the effectiveness of a CRM system largely depends on the quality of the data it handles. Once you make a choice on the platform, having clear, accountable processes for use by the team is crucial in the ROI you’ll get from whichever CRM you decide on.

For investment firms grappling with substantial data volumes, stringent compliance requirements, and time constraints, it’s of utmost importance to prioritize a dependable, high-end CRM solution for the sales team. Conversely, if you represent a smaller business not primarily focused on investments, opting for a more compact and versatile CRM such as HubSpot can be the best choice. These solutions can streamline data and contact management, allowing you to allocate more time to customer-centric activities.

If you have budget constraints, it’s worth considering the free versions of these CRM platforms as an excellent short-term solution. This approach can prove ideal as you plan for future growth in the upcoming quarters or year